Please select the type of

form you would like to import:

W2

Forms

1099-MISC

Forms

1099-INT

Forms

1099-DIV

Forms

1099-R

Forms

1099-S Forms

1099-A Forms

1099-B Forms

1099-C Forms

1099-PATR Forms

1099-OID Forms

1098-T Forms

1098 Forms

1099-K Forms

Company(s) Information

Importing W2 Forms

CSV (comma separated value) is the most common format used

in order to transfer data between different types of databases. Most software

and database applications will allow you to export W2 and 1099 data into CSV

format, which can then be imported into W2 Mate.

If

your

software

exports

data

to

Microsoft

Excel

format,

you

can

save

the

Excel

file

as

CSV

(Comma

Delimited)

and

then

do

the

import

into

W2

Mate.

IMPORTANT NOTE: A SAMPLE CSV FILE WITH W2 DATA CAN BE DOWNLOADED FROM HERE

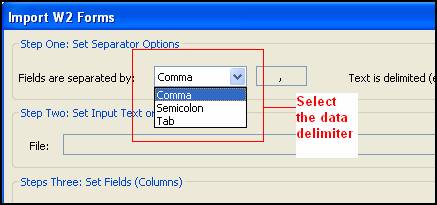

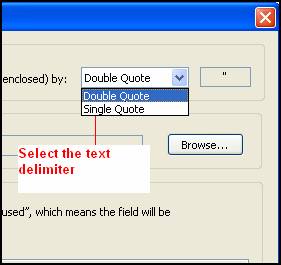

Steps for Importing W2

Form Data

- Go to

Import Data >> W2 Forms (CSV – Excel).

- In

the dialog that comes up:

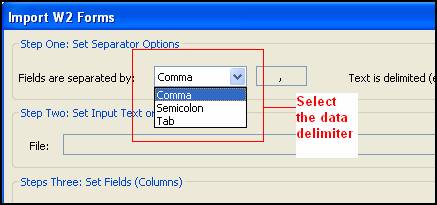

- Select

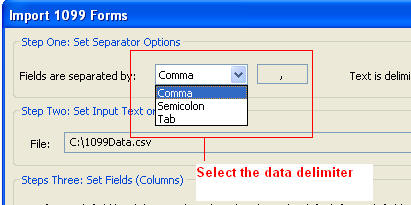

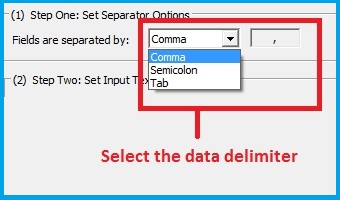

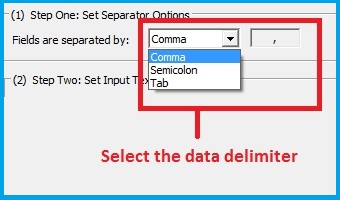

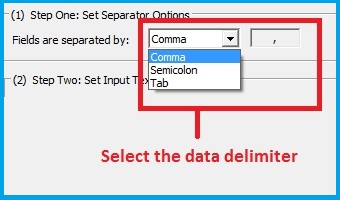

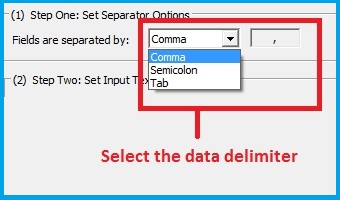

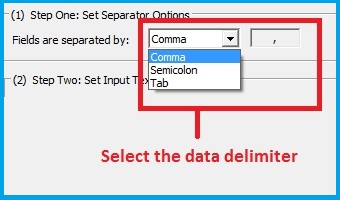

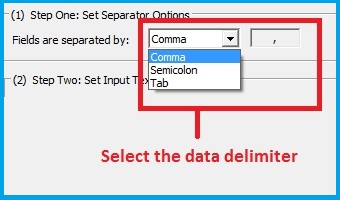

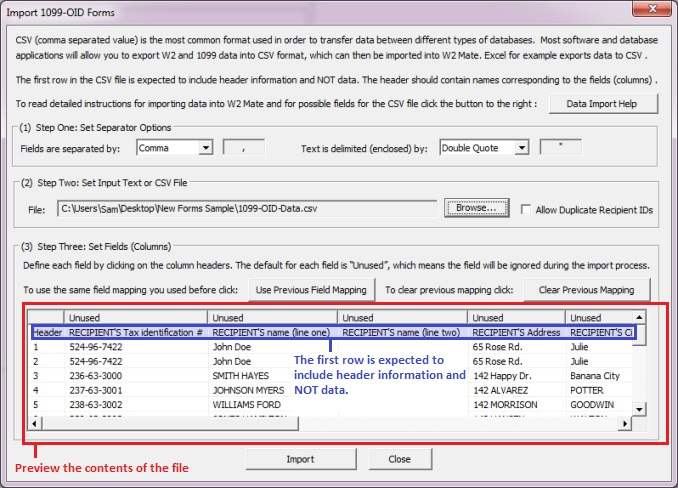

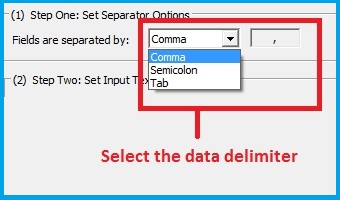

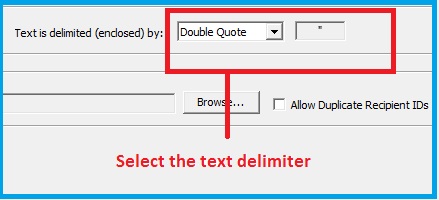

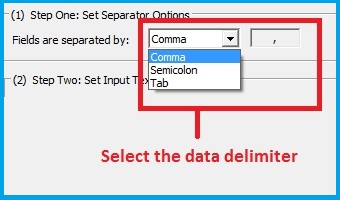

the character that is used to separate data categories (columns). The default value should be OK in most cases.

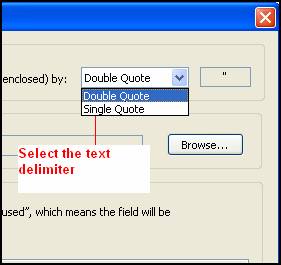

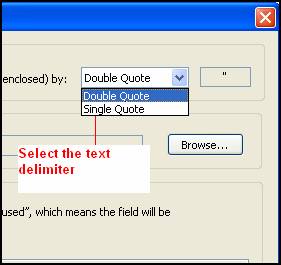

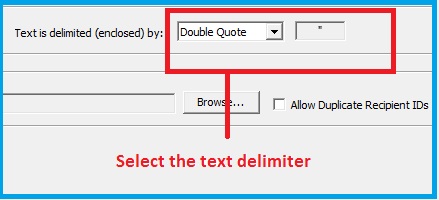

- Select

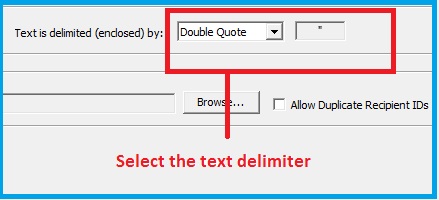

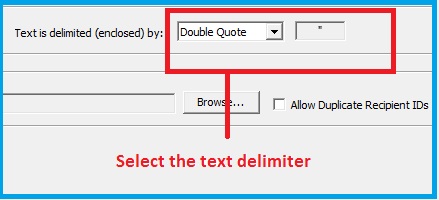

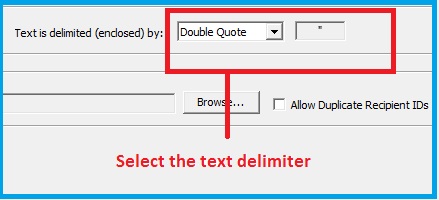

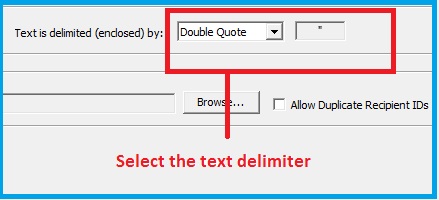

the character that is used to enclose strings. The default value should be OK in most cases.

- Select

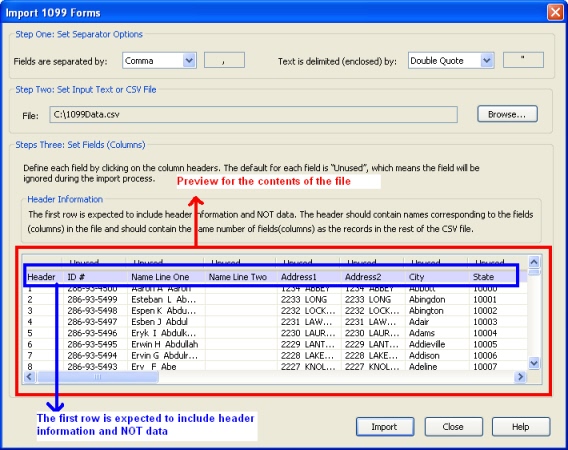

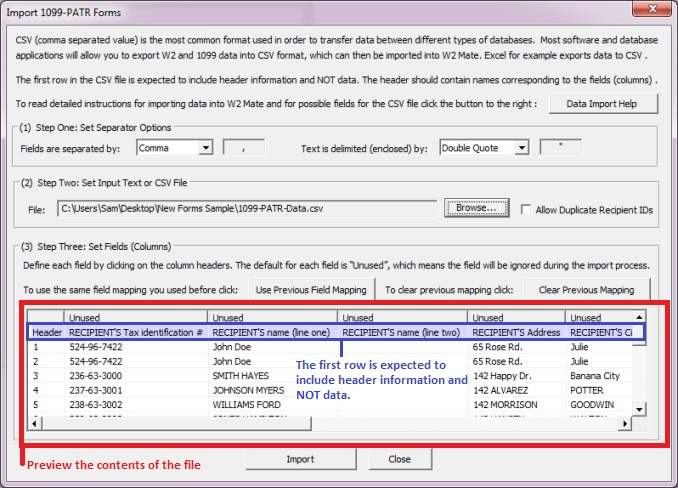

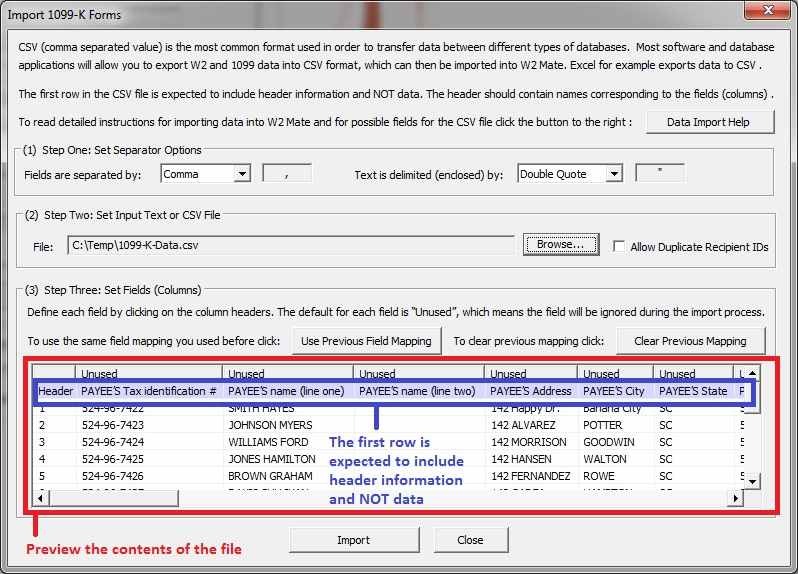

the input text or CSV file you are trying to import.

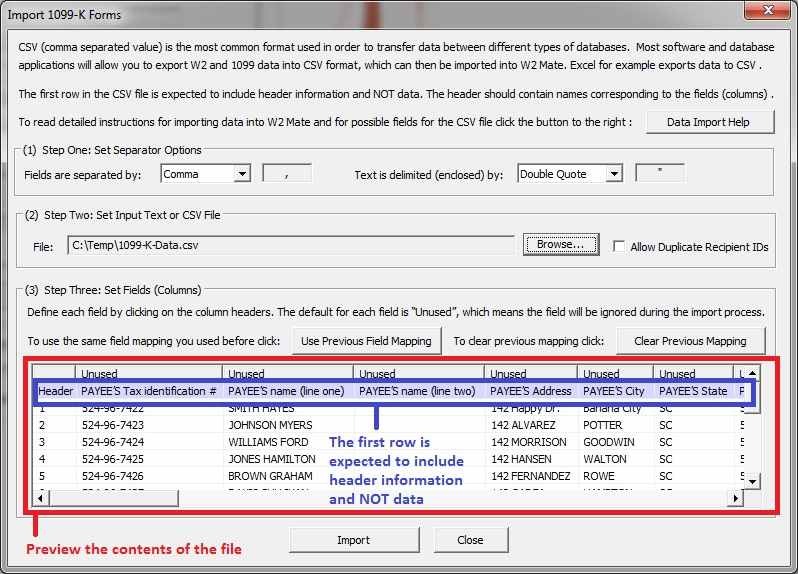

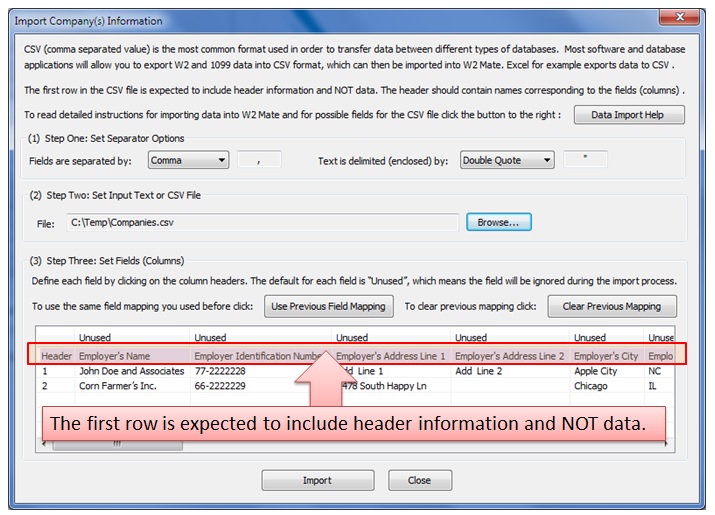

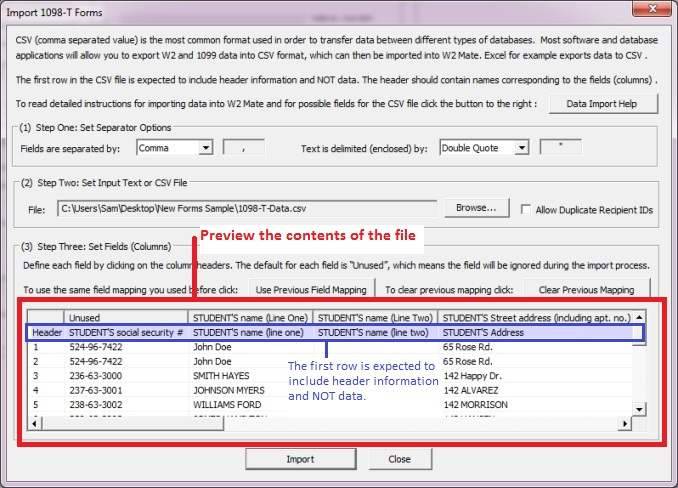

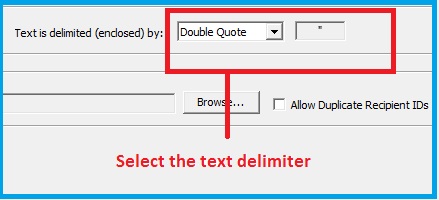

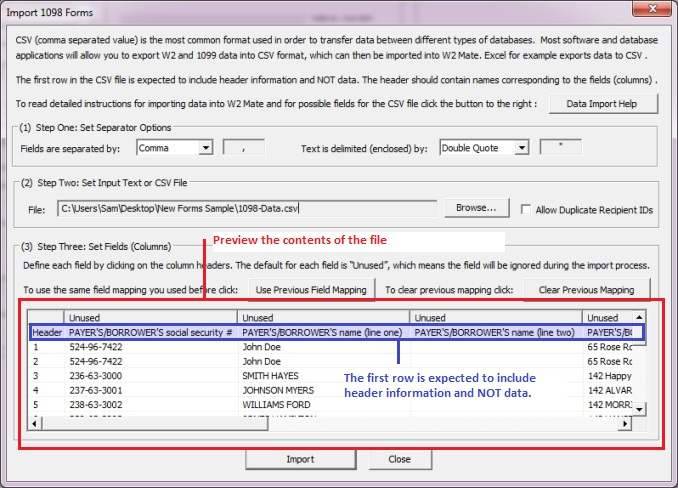

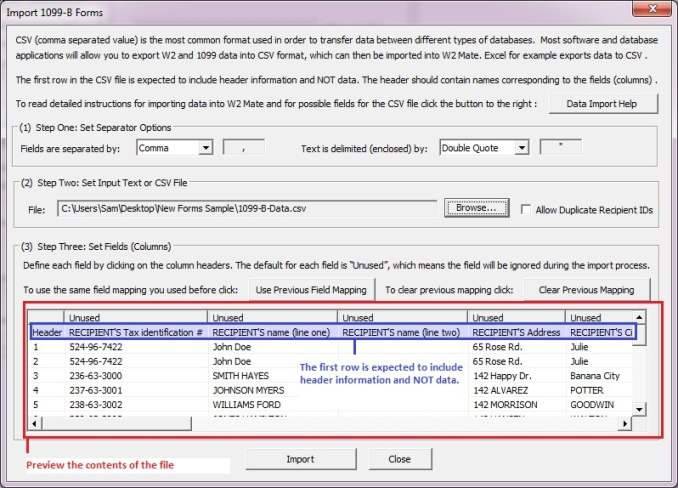

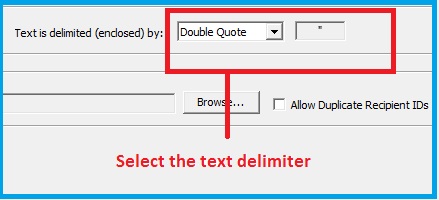

Important

Note: The first row is expected to include header information and NOT data. The

header should contain names corresponding to the fields (columns) in the file

and should contain the same number of fields (columns) as the records in the

rest of the CSV file.

Once you select the input file you

should see a preview for the contents of the file.

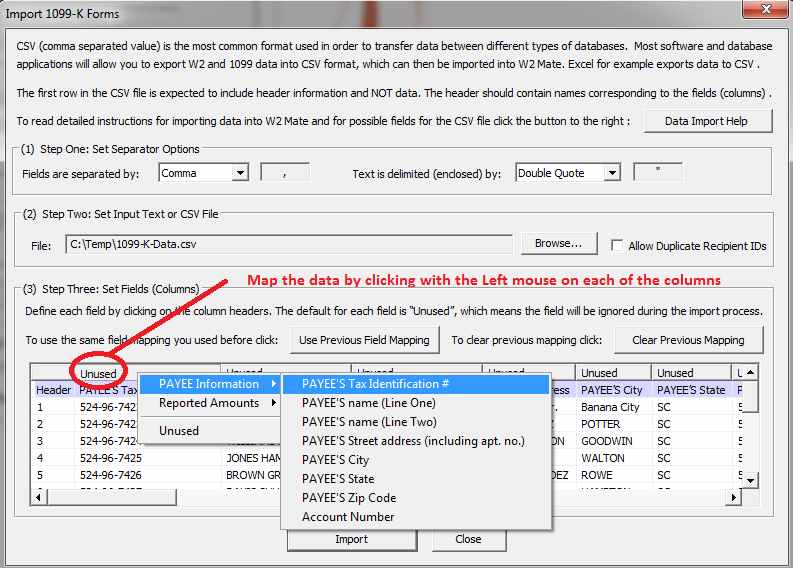

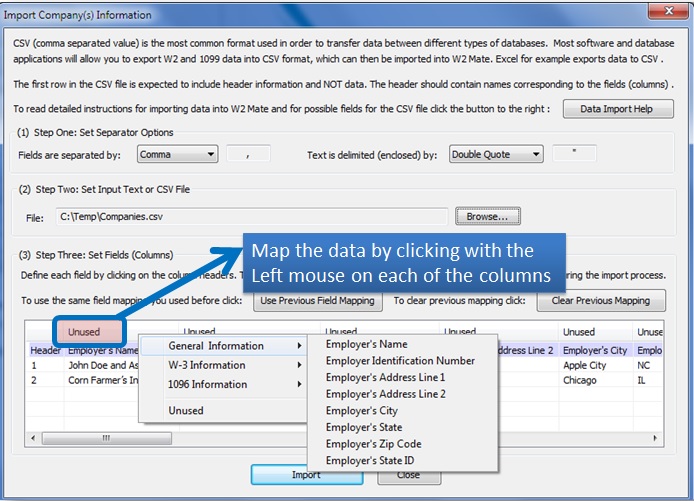

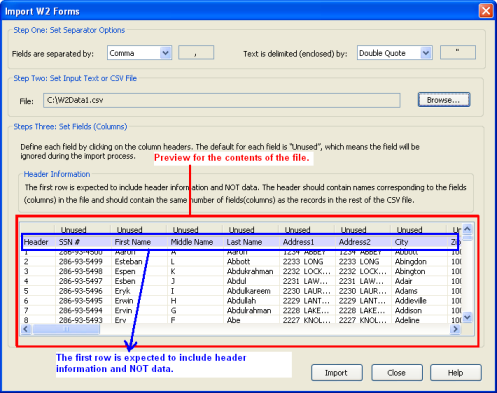

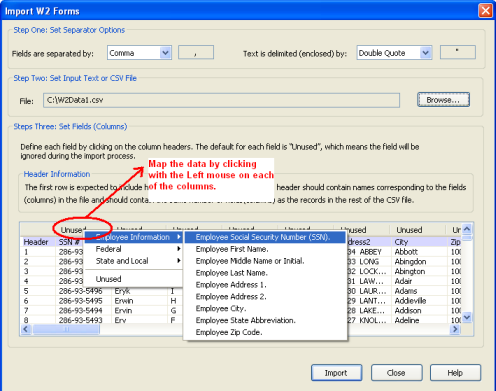

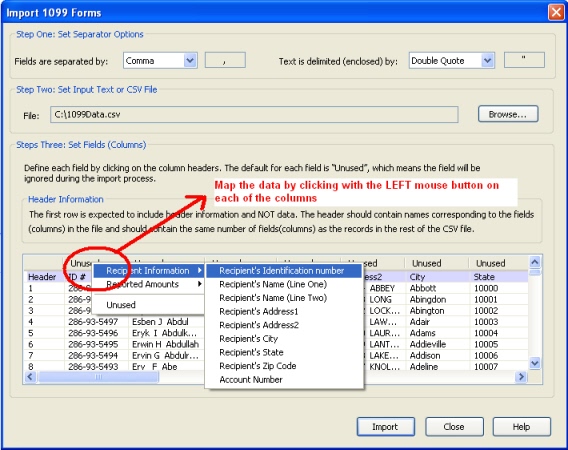

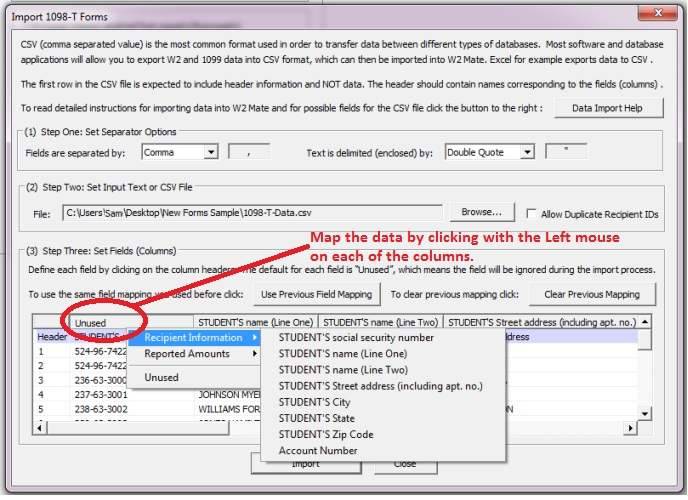

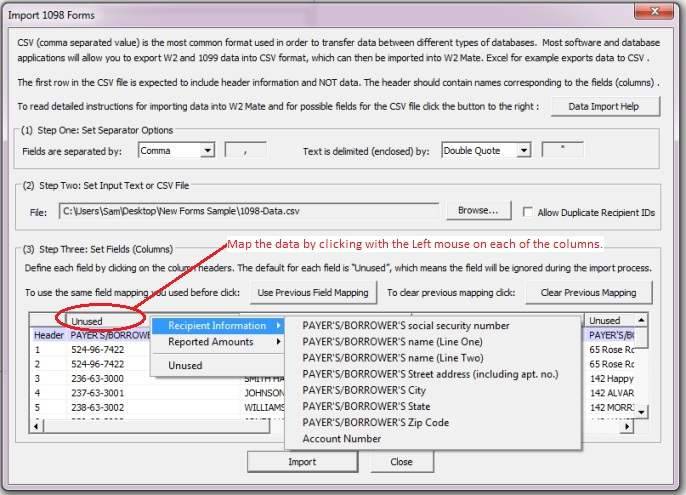

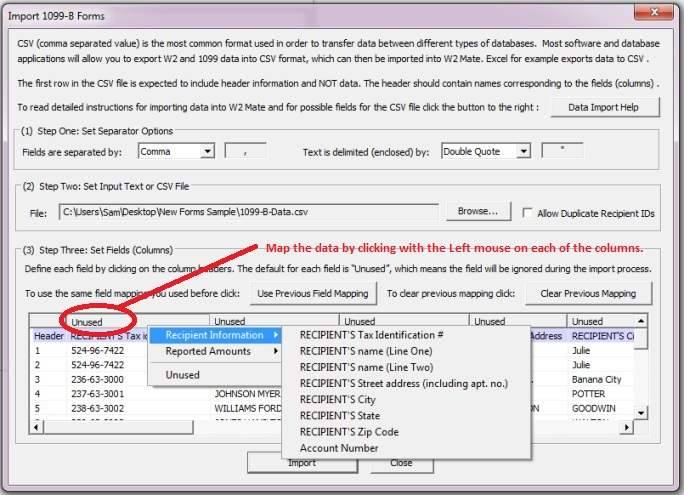

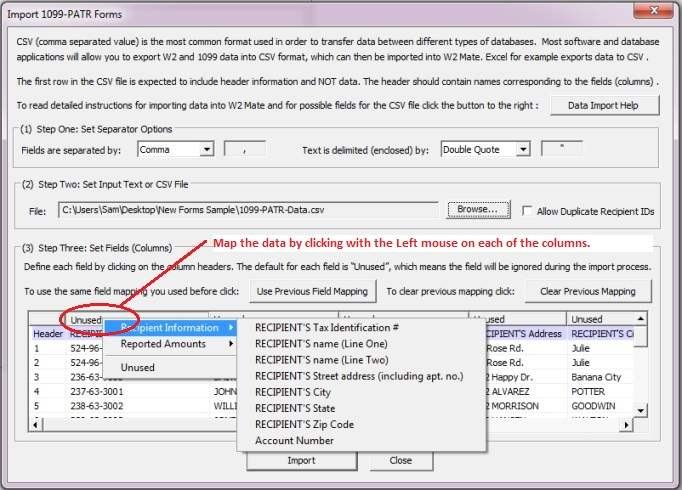

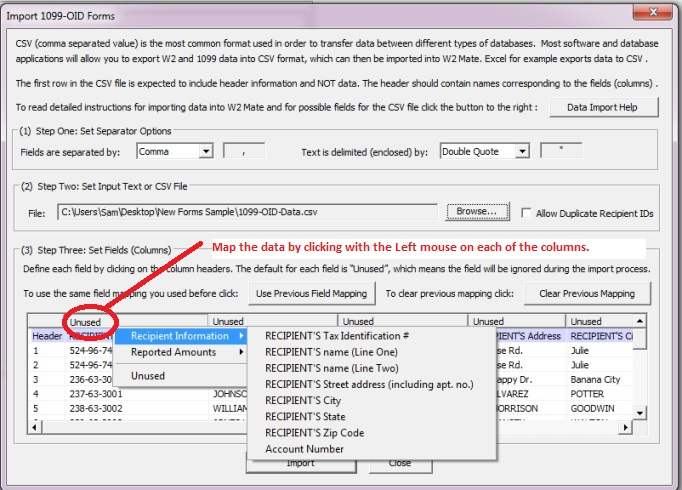

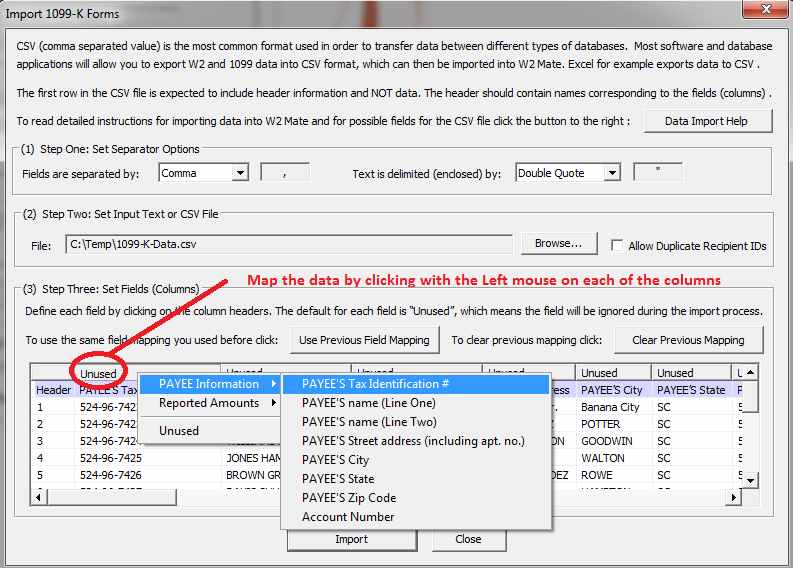

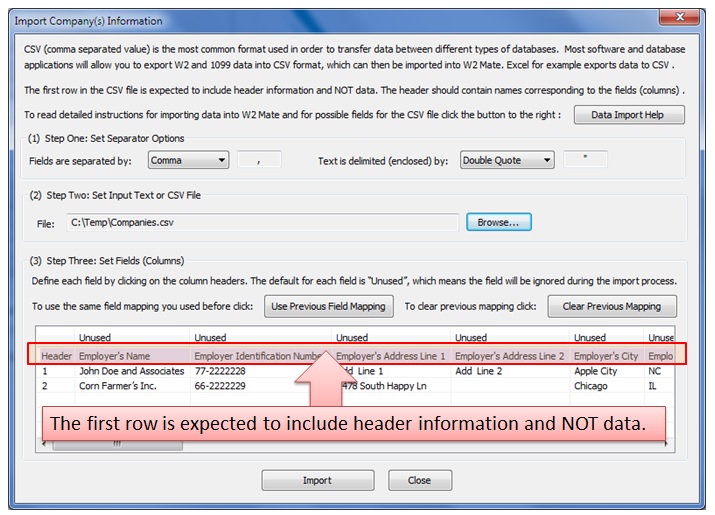

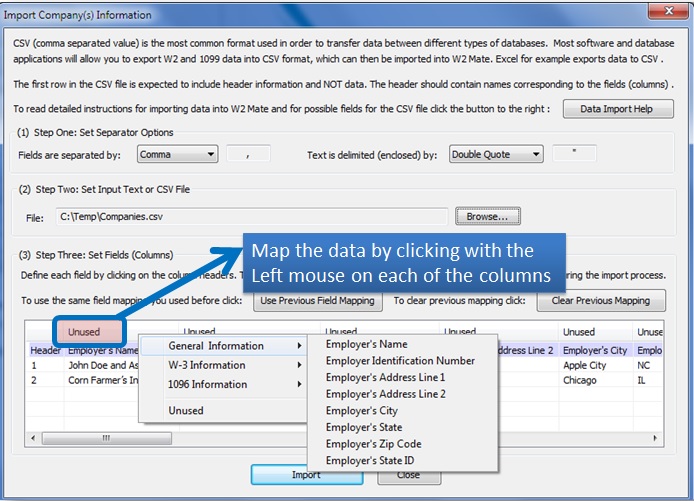

- Map

the data by clicking with the Left

mouse on each of the columns.

- Once

you have defined all the required fields, hit the Import button to import

the new data.

Possible Fields for the

CSV or Text File

|

Field Name

|

Notes

|

Example

|

|

Employee Social Security Number (SSN)

|

This is a mandatory field.

Must be formatted: xxx-xx-xxxx

|

605-74-4444

|

|

Employee First Name

|

This is a mandatory field.

Text field, maximum 20 characters long.

|

John

|

|

Employee Middle Name or Initial

|

Text field, maximum 2 characters long.

|

M.

|

|

Employee Last Name

|

This is a mandatory field.

Text field, maximum 20 characters long.

|

Doe

|

|

Employee Suff.

|

Text field, maximum 4 characters long.

|

Jr.

|

|

Employee Address 1

|

Text field, maximum 30 characters long.

|

South Orange Drive

|

|

Employee Address 2

|

Text field, maximum 30 characters long.

|

Apt. E.

|

|

Employee

City

|

Text field, maximum 20 characters long.

|

Banana

Town

|

|

Employee

State

Abbreviation

|

Must be one of the following:

AA, AC, AE,

AK,

AL, AP, AR, AS, AZ, CA,

CO, CT, DC, DE, FL, GA, GU, HI, IA, ID, IL,

IN, KS, KY, LA, MA, MD, ME, MI, MN, MO,

MP, MS, MT, NC, ND, NE, NH, NJ, NM, NV, NY, OH, OK, OR,

PA, PR, RI, SC, SD, TN, TX, UT, VA, VI, VT, WA, WI, WV, WY

|

IL

|

|

Employee Zip Code

|

Text field, maximum 11 characters long.

|

25201

|

|

Email Address

|

Text field, maximum 100 characters long.

|

johndoe@doejohn.com

|

|

Control number

|

Text field, maximum 20 characters long.

|

5264

|

|

Box

1 (Wages, Tips and Other Compensation)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

35400.52

|

|

Box

2 (Federal Income Tax Withheld)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5800.14

|

|

Box

3 (Social Security Wages)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

35600.52

|

|

Box

4 (Social Security Tax Withheld)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

1500.11

|

|

Box

5 (Medicare Wages and Tips)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

35600.52

|

|

Box

6 (Medicare Tax Withheld)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

1214.12

|

|

Box

7 (Social Security Tips)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

1500

|

|

Box

8 (Allocated Tips)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

450.1

|

|

Box

9 (Verification code)

|

Reserved

|

|

|

Box

10 (Dependent Care Benefits)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

1255.12

|

|

Box

11 (Nonqualified Plans)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

500

|

|

Box 12a Code

|

Text field, maximum two characters long.

|

D

|

|

Box

12a Amount

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

650.1

|

|

Box

12b Code

|

Text field, maximum two characters long.

|

E

|

|

Box

12b Amount

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

121.2

|

|

Box

12c Code

|

Text field, maximum two characters long.

|

F

|

|

Box

12c Amount

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

1470.1

|

|

Box 12d Code

|

Text field, maximum two characters long.

|

Y

|

|

Box 12d Amount

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

750.1

|

|

Statutory employee

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

0

|

|

Retirement plan

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

1

|

|

Third-party sick pay

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

0

|

|

Other Line 1

|

Text field, maximum 14 characters long.

|

Other Text 1

|

|

Other Line 2

|

Text field, maximum 14 characters long.

|

Other Text 2

|

|

Other Line 3

|

Text field, maximum 14 characters long.

|

Other Text 3

|

|

State

(Line 1)

|

Must be one of the following : AA, AC, AE, AK, AL, AP, AR, AS, AZ, CA, CO, CT, DC, DE, FL, GA, GU, HI, IA, ID, IL, IN, KS, KY, LA, MA, MD, ME, MI, MN, MO, MP, MS, MT, NC, ND, NE, NH, NJ, NM, NV, NY, OH, OK, OR, PA, PR, RI, SC, SD, TN, TX, UT, VA, VI, VT, WA, WI, WV or WY.

To force W2 Mate to keep this field empty enter "NO" (without quotations).

|

NC

|

|

Employer’s state ID number (Line 1)

|

Text field, maximum 15 characters long.

|

8554-555-1

|

|

State wages, tips, etc. (Line 1)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

35412.12

|

|

State income tax (Line 1)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

3500.12

|

|

Local wages, tips, etc. (Line 1)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

35412.12

|

|

Local income tax (Line 1)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

588.12

|

|

Locality name (Line 1)

|

Text field, maximum 6 characters long.

|

Apple

|

|

State (Line 2)

|

Must be one of the following : AA, AC, AE, AK, AL, AP, AR, AS, AZ, CA, CO, CT, DC, DE, FL, GA, GU, HI, IA, ID, IL, IN, KS, KY, LA, MA, MD, ME, MI, MN, MO, MP, MS, MT, NC, ND, NE, NH, NJ, NM, NV, NY, OH, OK, OR, PA, PR, RI, SC, SD, TN, TX, UT, VA, VI, VT, WA, WI, WV or WY.

|

NY

|

|

Employer’s state ID number (Line 2)

|

Text field, maximum 15 characters long.

|

85YE555-1

|

|

State wages, tips, etc. (Line 2)

|

Numeric field (shouldn’t include any non-numeric characters

like a ",").

|

18454.2

|

|

State income tax (Line 2)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

754.1

|

|

Local wages, tips, etc. (Line 2)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5412.12

|

|

Local income tax (Line 2)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

188.12

|

|

Locality name (Line 2)

|

Text field, maximum 6 characters long.

|

Banana

|

Importing 1099-MISC Forms

CSV (comma separated value) is the most common format used

in order to transfer data between different types of databases. Most software

and database applications will allow you to export W2 and 1099 data into CSV

format, which can then be imported into W2 Mate.

If

your

software

exports

data

to

Microsoft

Excel

format,

you

can

save

the

Excel

file

as

CSV

(Comma

Delimited)

and

then

do

the

import

into

W2

Mate.

IMPORTANT NOTE: A SAMPLE CSV FILE WITH 1099 DATA CAN BE DOWNLOADED FROM HERE

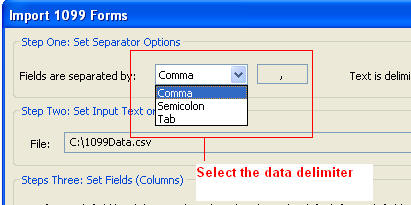

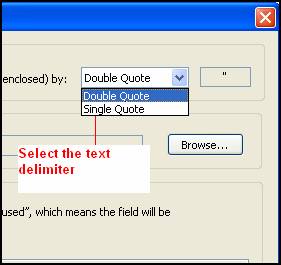

Steps for Importing 1099

Form Data

- Go to

Import Data>> 1099-Misc Forms (CSV – Excel).

- In

the dialog that comes up:

- Select

the character that is used to separate data categories (columns). The default value should be OK in most cases.

- Select

the character that is used to enclose strings. The default value should be OK in most cases.

- Select

the input text or CSV file you are trying to import.

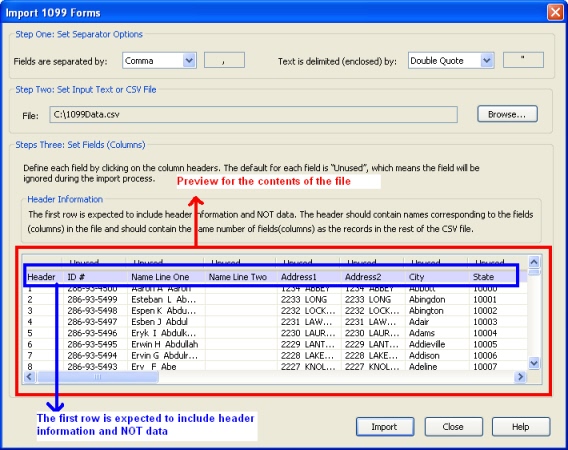

Important

Note: The first row is expected to include header information and NOT data. The

header should contain names corresponding to the fields (columns) in the file

and should contain the same number of fields (columns) as the records in the

rest of the CSV file.

Once you select the input file you

should see a preview for the contents of the file.

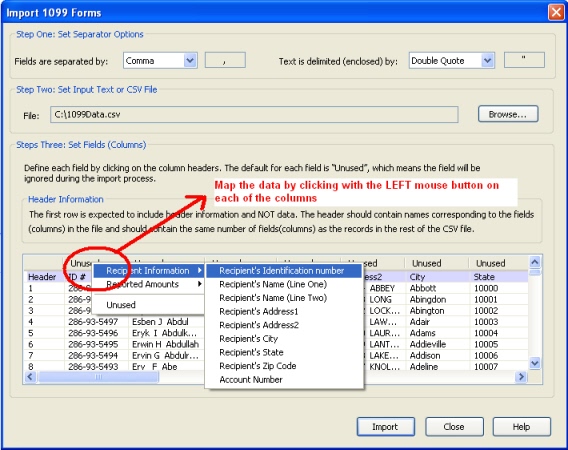

- Map

the data by clicking with the Left

mouse on each of the columns.

- Once

you have defined all the required fields, hit the Import button to import

the new data.

Possible Fields for the

CSV or Text File

|

Field Name

|

Notes

|

Example

|

|

Recipient's Identification number

|

This is a mandatory field.

Text field, maximum 11 characters long.

|

652-45-7888

|

|

Recipient's Name (Line One)

|

This is a mandatory field.

Text field, maximum 40 characters long.

|

John Doe

|

|

Recipient's Name (Line Two)

|

Text field, maximum 40 characters long.

|

|

|

Recipient's Address1

|

Text field, maximum 30 characters long.

|

South Orange Drive

|

|

Recipient's Address2

|

Text field, maximum 30 characters long.

|

Apt. E.

|

|

Recipient's City

|

Text field, maximum 20 characters long.

|

Banana

Town

|

|

Recipient's State

|

Must be one of the following:

AA, AC, AE,

AK,

AL, AP, AR, AS, AZ, CA,

CO, CT, DC, DE, FL, GA, GU, HI, IA, ID, IL,

IN, KS, KY, LA, MA, MD, ME, MI, MN, MO,

MP, MS, MT, NC, ND, NE, NH, NJ, NM, NV, NY,

OH, OK, OR, PA, PR, RI, SC, SD, TN, TX, UT, VA,

VI, VT, WA, WI, WV, WY

|

IL

|

|

Recipient's Zip Code

|

Text field, maximum 11 characters long.

|

25201

|

|

Email Address

|

Text field, maximum 100 characters long.

|

janedoe@janedoeinc.com

|

|

Account Number

|

Text field, maximum 12 characters long.

|

652-999

|

|

Box

1 (Rents)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5666.26

|

|

Box

2 (Royalties)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5721.38

|

|

Box

3 (Other income)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5776.5

|

|

Box

4 (Federal income tax withheld)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5831.62

|

|

Box

5 (Fishing boat proceeds)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5886.74

|

|

Box

6 (Medical and health care payments)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5941.86

|

|

Box

7 (Nonemployee

compensation)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5996.98

|

|

Box

8 (Substitute payments in lieu of

dividends or interest)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

6052.1

|

|

Box 9 (Payer made direct sales of $5000 or more...)

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

0

|

|

Box

10 (Crop insurance proceeds)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

6162.34

|

|

Box11 (Foreign tax paid)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

823.14

|

|

Box

13 (Excess golden parachute payments)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

6217.46

|

|

Box

14 (Gross proceeds paid to an attorney)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

6272.58

|

|

Box

15a (Section 409A deferrals)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

6327.7

|

|

Box

15b (Section 409A income)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

115.15

|

|

Box

16 (State tax withheld) Line 1

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

121.1

|

|

Box

17 (State/Payer's state no.) Line 1

|

Text field, maximum 20 characters long. Must be formatted State Abbreviation/State ID such as IL/2851417 .

|

IL/2851417

|

|

Box

18 (State income) Line 1

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

25212.12

|

|

Box

16 (State tax withheld) Line 2

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

2351.1

|

|

Box

17 (State/Payer's state no.) Line 2

|

Text field, maximum 20 characters long. Must be formatted State Abbreviation/State ID such as IL/2851417 .

|

IL/2851417

|

|

Box

18 (State income) Line 2

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

36212.12

|

|

FATCA filing requirement

|

This field can either be 1 or 0.

1 means the check box is checked and 0, means it is unchecked.

|

0

|

|

2nd TIN not.

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

0

|

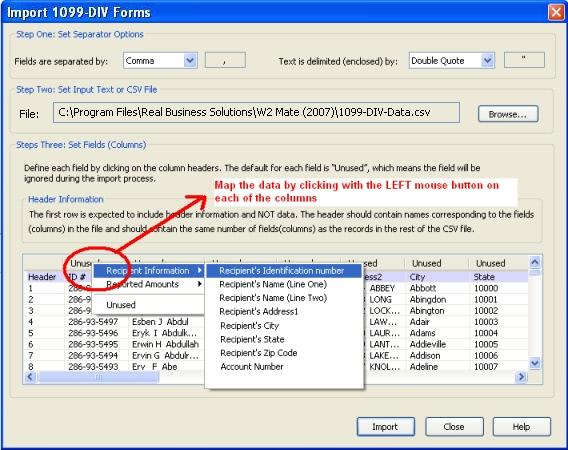

Importing 1099-DIV Forms

CSV (comma separated value) is the most common format used

in order to transfer data between different types of databases. Most software

and database applications will allow you to export 1099 data into CSV

format, which can then be imported into W2 Mate.

If

your

software

exports

data

to

Microsoft

Excel

format,

you

can

save

the

Excel

file

as

CSV

(Comma

Delimited)

and

then

do

the

import

into

W2

Mate.

IMPORTANT NOTE: A SAMPLE CSV FILE WITH 1099 DIV DATA CAN BE DOWNLOADED FROM HERE

Steps for Importing 1099

Form Data

- Go

to Import Data>> 1099-Div Forms (CSV – Excel).

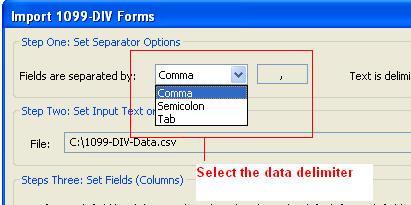

- In the

dialog that comes up:

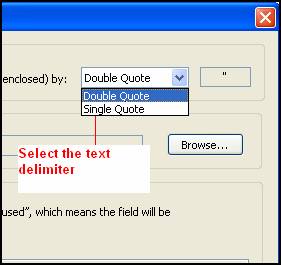

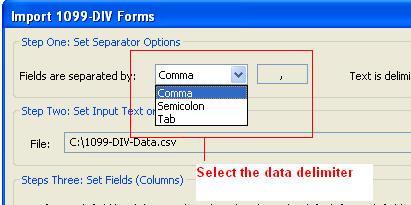

- Select

the character that is used to separate data categories (columns). The default value should be OK in most cases.

- Select

the character that is used to enclose strings. The default value should be OK in most cases.

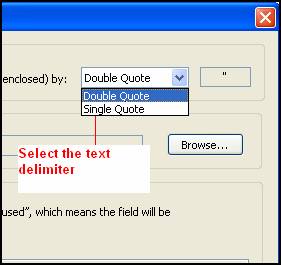

- Select

the input text or CSV file you are trying to import.

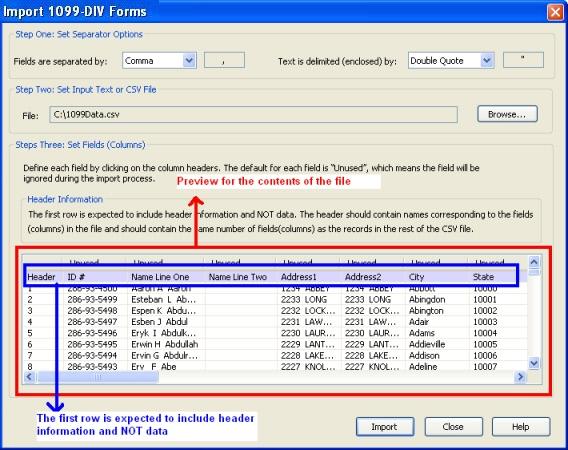

Important

Note: The first row is expected to include header information and NOT data. The

header should contain names corresponding to the fields (columns) in the file

and should contain the same number of fields (columns) as the records in the

rest of the CSV file.

Once you select the input file you

should see a preview for the contents of the file.

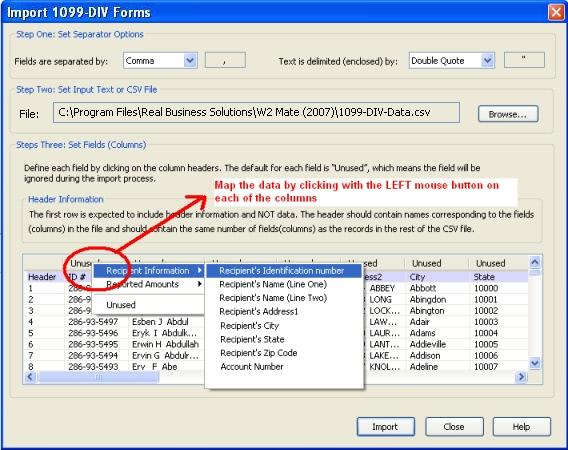

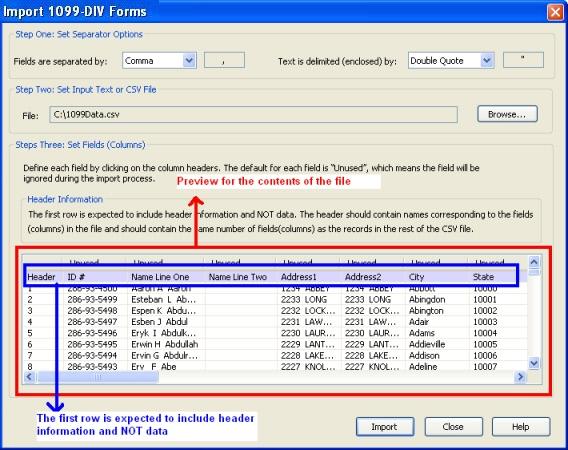

- Map

the data by clicking with the Left

mouse on each of the columns.

- Once

you have defined all the required fields, hit the Import button to import

the new data.

Possible Fields for the

CSV or Text File

|

Field Name

|

Notes

|

Example

|

|

Recipient's Identification number

|

This is a mandatory field.

Text field, maximum 11 characters long.

|

652-45-7888

|

|

Recipient's Name (Line One)

|

This is a mandatory field.

Text field, maximum 40 characters long.

|

John Doe

|

|

Recipient's Name (Line Two)

|

Text field, maximum 40 characters long.

|

|

|

Recipient's Address1

|

Text field, maximum 30 characters long.

|

South Orange Drive

|

|

Recipient's Address2

|

Text field, maximum 30 characters long.

|

Suite 500

|

|

Recipient's City

|

Text field, maximum 20 characters long.

|

Banana

Town

|

|

Recipient's State

|

Must be one of the following:

AA, AC, AE,

AK,

AL, AP, AR, AS, AZ, CA,

CO, CT, DC, DE, FL, GA, GU, HI, IA, ID, IL,

IN, KS, KY, LA, MA, MD, ME, MI, MN, MO,

MP, MS, MT, NC, ND, NE, NH, NJ, NM, NV, NY,

OH, OK, OR, PA, PR, RI, SC, SD, TN, TX, UT, VA,

VI, VT, WA, WI, WV, WY

|

IL

|

|

Recipient's Zip Code

|

Text field, maximum 11 characters long.

|

25201

|

|

Account Number

|

Text field, maximum 12 characters long.

|

652-999

|

|

Box

1a (Total

ordinary dividends)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5666.26

|

|

Box

1b (Qualified

dividends)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5721.38

|

|

Box

2a (Total

capital gain distr.)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5776.5

|

|

Box

2b (Unrecap. Sec. 1250 gain)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5831.62

|

|

Box

2c (Section

1202 gain)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5886.74

|

|

Box 2d

(Collectibles (28%) gain)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5941.86

|

|

Box

3 (Nondividend distributions)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5996.98

|

|

Box

4 (Federal

income tax withheld)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

6052.1

|

|

Box 5 (Section 199A dividends)

|

Numeric field (shouldn’t include any non-numeric characters like a ",").

|

58.31

|

|

Box

6 (Investment

expenses)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

500.00

|

|

Box

7 (Foreign tax paid)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

6162.34

|

|

Box

8 (Foreign country or U.S.

possession)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

6217.46

|

|

Box

9 (Cash liquidation distributions)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

6272.58

|

|

Box

10 (Noncash

liquidation distributions)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

6327.7

|

|

Box 11 Exempt-interest dividends

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

205.6

|

|

Box 12 Specified private activity bond interest dividends

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

651.4

|

|

Box 13 State

|

Must be one of the following:

AA, AC, AE,

AK,

AL, AP, AR, AS, AZ, CA,

CO, CT, DC, DE, FL, GA, GU, HI, IA, ID, IL,

IN, KS, KY, LA, MA, MD, ME, MI, MN, MO,

MP, MS, MT, NC, ND, NE, NH, NJ, NM, NV, NY,

OH, OK, OR, PA, PR, RI, SC, SD, TN, TX, UT, VA,

VI, VT, WA, WI, WV, WY

|

NC

|

|

Box 14 State identification no

|

Text field, maximum 20 characters long.

|

8554-555-1

|

|

Box 15 State tax withheld

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

205.6

|

|

FATCA filing requirement

|

This field can either be 1 or 0.

1 means the check box is checked and 0, means it is unchecked.

|

0

|

|

2nd TIN not.

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

0

|

Importing 1099-INT Forms

CSV (comma separated value) is the most common format used

in order to transfer data between different types of databases. Most software

and database applications will allow you to export 1099 data into CSV format,

which can then be imported into W2 Mate.

If

your

software

exports

data

to

Microsoft

Excel

format,

you

can

save

the

Excel

file

as

CSV

(Comma

Delimited)

and

then

do

the

import

into

W2

Mate.

IMPORTANT NOTE: A SAMPLE CSV FILE WITH 1099 INT DATA CAN BE DOWNLOADED FROM HERE

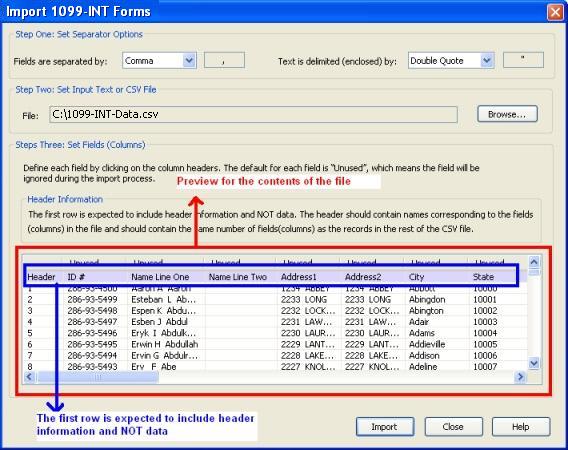

Steps for Importing

1099-INT Form Data

- Go to

Import Data>> 1099-INT Forms (CSV – Excel).

- In

the dialog that comes up:

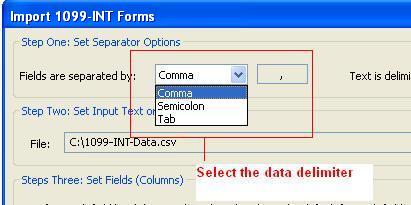

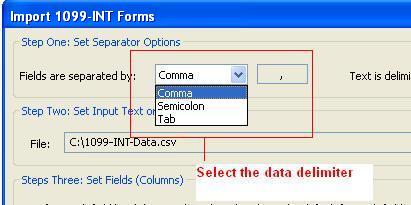

- Select

the character that is used to separate data categories (columns). The default value should be OK in most cases.

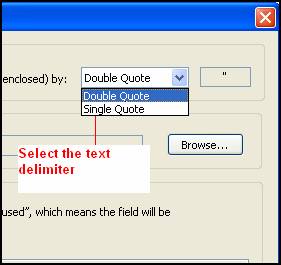

- Select

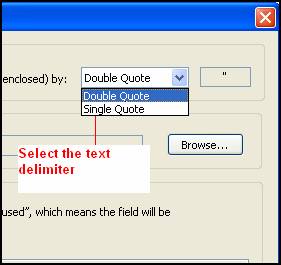

the character that is used to enclose strings. The default value should be OK in most cases.

- Select

the input text or CSV file you are trying to import.

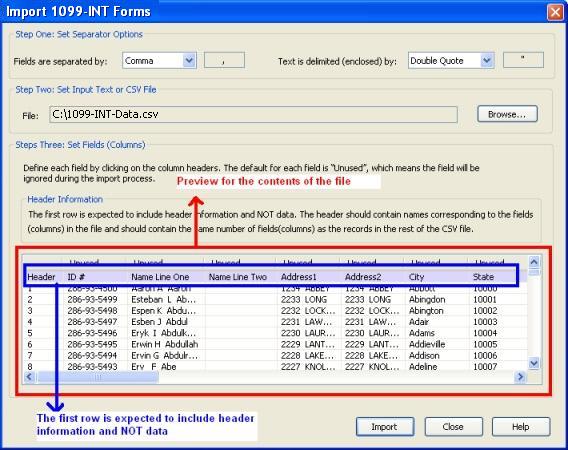

Important

Note: The first row is expected to include header information and NOT data. The

header should contain names corresponding to the fields (columns) in the file

and should contain the same number of fields (columns) as the records in the

rest of the CSV file.

Once you select the input file you

should see a preview for the contents of the file.

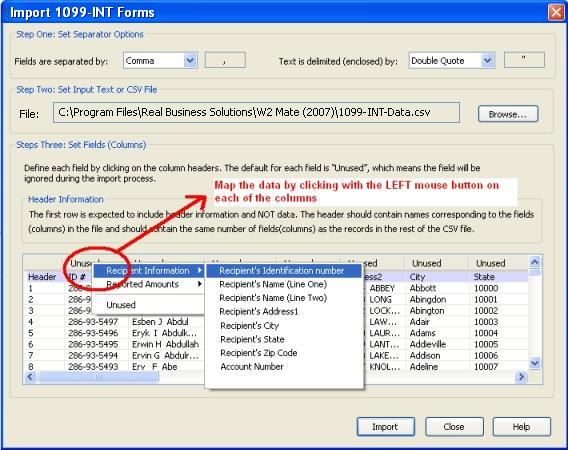

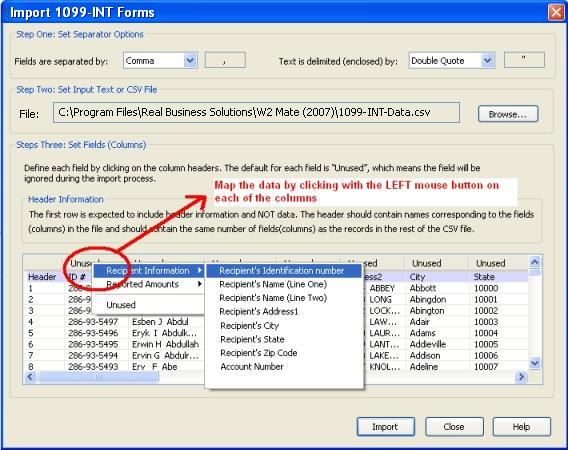

- Map

the data by clicking with the Left

mouse on each of the columns.

- Once

you have defined all the required fields, hit the Import button to import

the new data.

Possible Fields for the

CSV or Text File

|

Field Name

|

Notes

|

Example

|

|

Recipient's Identification number

|

This is a mandatory field.

Text field, maximum 11 characters long.

|

652-45-7888

|

|

Recipient's Name (Line One)

|

This is a mandatory field.

Text field, maximum 40 characters long.

|

John Doe

|

|

Recipient's Name (Line Two)

|

Text field, maximum 40 characters long.

|

|

|

Recipient's Address1

|

Text field, maximum 30 characters long.

|

South Orange Drive

|

|

Recipient's Address2

|

Text field, maximum 30 characters long.

|

Suite 500

|

|

Recipient's City

|

Text field, maximum 20 characters long.

|

Banana

Town

|

|

Recipient's State

|

Must be one of the following:

AA, AC, AE,

AK,

AL, AP, AR, AS, AZ, CA,

CO, CT, DC, DE, FL, GA, GU, HI, IA, ID, IL,

IN, KS, KY, LA, MA, MD, ME, MI, MN, MO,

MP, MS, MT, NC, ND, NE, NH, NJ, NM, NV, NY,

OH, OK, OR, PA, PR, RI, SC, SD, TN, TX, UT, VA,

VI, VT, WA, WI, WV, WY

|

IL

|

|

Recipient's Zip Code

|

Text field, maximum 11 characters long.

|

25201

|

|

Account Number

|

Text field, maximum 12 characters long.

|

652-999

|

|

Payer's RTN

|

Text field, maximum 18 characters long

|

325272021

|

|

Box

1 (Interest

income)

|

Numeric field (shouldn’t include any non-numeric characters

like a ",").

|

5666.26

|

|

Box

2 (Early withdrawal penalty)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5721.38

|

|

Box 3(Interest on U.S Savings Bonds and Treas. obligations)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5776.5

|

|

Box

4 (Federal income tax withheld)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5831.62

|

|

Box

5 (Investment expenses)

|

Numeric field (shouldn’t include any non-numeric characters

like a ",").

|

5886.74

|

|

Box

6 (Foreign tax paid)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5941.86

|

|

Box

7 (Foreign country or U.S.

possession)

|

Text field, maximum 38 characters long

|

Japan

|

|

Box 8 (Tax-exempt interest)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

500.1

|

|

Box 9 (Specified private activity bond interest)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

100.2

|

Box 10 Market discount

|

Numeric field (shouldn’t include any non-numeric characters like a ",").

|

1458.25

|

Box 11 Bond premium

|

Numeric field (shouldn’t include any non-numeric characters like a ",").

|

863.25

|

Box 13 Bond premium on tax–exempt bond

|

Numeric field (shouldn’t include any non-numeric characters like a ",").

|

55.39

|

|

Box 14 Tax-exempt bond CUSIP no.

|

Text field, maximum 9 characters long.

|

345370860

|

|

Box 15 State

|

Must be one of the following:

AA, AC, AE,

AK,

AL, AP, AR, AS, AZ, CA,

CO, CT, DC, DE, FL, GA, GU, HI, IA, ID, IL,

IN, KS, KY, LA, MA, MD, ME, MI, MN, MO,

MP, MS, MT, NC, ND, NE, NH, NJ, NM, NV, NY,

OH, OK, OR, PA, PR, RI, SC, SD, TN, TX, UT, VA,

VI, VT, WA, WI, WV, WY

|

NC

|

|

Box 16 State identification no

|

Text field, maximum 20 characters long.

|

8554-555-1

|

|

Box 17 State tax withheld

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

205.6

|

|

FATCA filing requirement

|

This field can either be 1 or 0.

1 means the check box is checked and 0, means it is unchecked.

|

0

|

|

2nd TIN not.

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

0

|

Importing 1099-R Forms

CSV (comma separated value) is the most common format used in

order to transfer data between different types of databases. Most software and

database applications will allow you to export 1099 data into CSV

format, which can then be imported into W2 Mate.

If

your

software

exports

data

to

Microsoft

Excel

format,

you

can

save

the

Excel

file

as

CSV

(Comma

Delimited)

and

then

do

the

import

into

W2

Mate.

IMPORTANT NOTE: A SAMPLE CSV FILE WITH 1099 R DATA CAN BE DOWNLOADED FROM HERE

Steps for Importing

1099-R Form Data

- Go

to Import Data>> 1099-R Forms (CSV – Excel).

- In

the dialog that comes up:

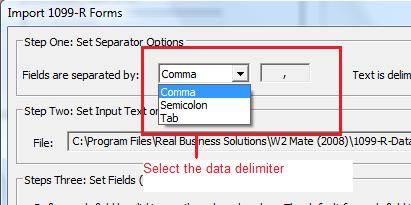

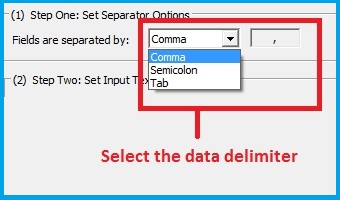

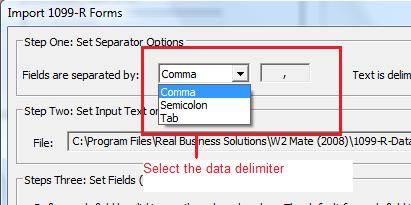

- Select

the character that is used to separate data categories (columns). The default value should be OK in most cases.

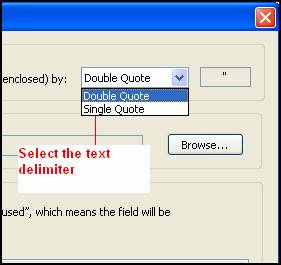

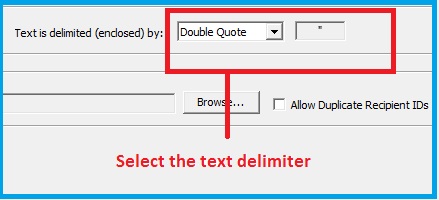

- Select

the character that is used to enclose strings. The default value should be OK in most cases.

- Select

the input text or CSV file you are trying to import.

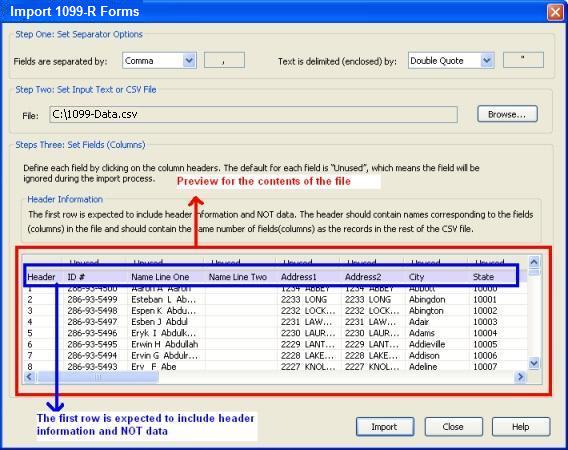

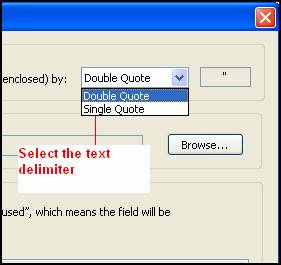

Important

Note: The first row is expected to include header information and NOT data. The

header should contain names corresponding to the fields (columns) in the file

and should contain the same number of fields (columns) as the records in the

rest of the CSV file.

Once you select the input file you

should see a preview for the contents of the file.

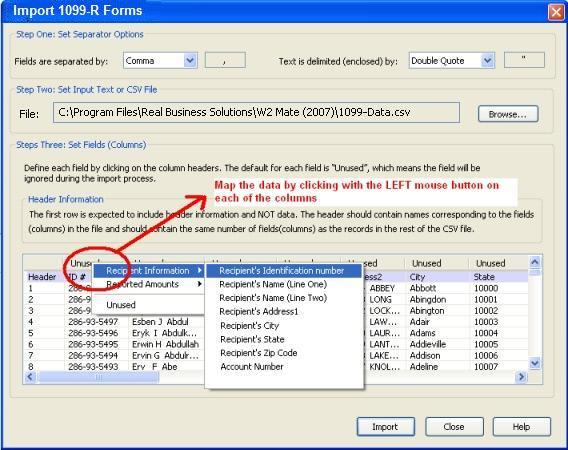

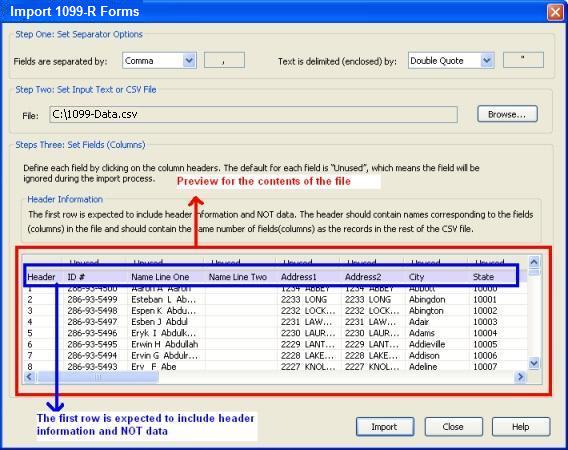

- Map

the data by clicking with the Left

mouse on each of the columns.

- Once

you have defined all the required fields, hit the Import button to import

the new data.

Possible Fields for the

CSV or Text File

|

Field Name

|

Notes

|

Example

|

|

Recipient's Identification number

|

This is a mandatory field.

Text field, maximum 11 characters long.

|

652-45-7888

|

|

Recipient's Name (Line One)

|

This is a mandatory field.

Text field, maximum 40 characters long.

|

John Doe

|

|

Recipient's Name (Line Two)

|

Text field, maximum 40 characters long.

|

|

|

Recipient's Address1

|

Text field, maximum 30 characters long.

|

South Orange Drive

|

|

Recipient's City

|

Text field, maximum 20 characters long.

|

Banana

Town

|

|

Recipient's State

|

Must be one of the following:

AA, AC, AE,

AK,

AL, AP, AR, AS, AZ, CA,

CO, CT, DC, DE, FL, GA, GU, HI, IA, ID, IL,

IN, KS, KY, LA, MA, MD, ME, MI, MN, MO,

MP, MS, MT, NC, ND, NE, NH, NJ, NM, NV, NY,

OH, OK, OR, PA, PR, RI, SC, SD, TN, TX, UT, VA,

VI, VT, WA, WI, WV, WY

|

IL

|

|

Recipient's Zip Code

|

Text field, maximum 11 characters long.

|

25201

|

|

Account Number

|

Text field, maximum 12 characters long.

|

652-999

|

|

Box

1:Gross

distribution

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5666.26

|

|

Box

2a:Taxable amount

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5721.38

|

|

Box

2b:Taxable amount not determined

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

0

|

|

Box

2b: Total distribution

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

1

|

|

Box

3:Capital gain (included in box

2a)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5886.74

|

|

Box

4:Federal income tax withheld

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5941.86

|

|

Box

5:Emp. contribs.

/Des. Roth contribs. or ins. premiums

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

100.2

|

|

Box

6:Net unrealized appreciation in

employer’s securities

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

10.23

|

|

Box

7:Distribution code(s)

|

Text field, maximum 6 characters long

|

B

|

|

Box

7:IRA/SEP/SIMPLE

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

0

|

|

Box

8:Other

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

100.2

|

|

Box

8:%

|

A whole number between 1 and 99

|

10

|

|

Box

9a:Your percentage of total distribution

|

A whole number between 1 and 99

|

15

|

|

Box

9b:Total employee contributions

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

455.63

|

|

Box

12:State tax withheld

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

355.12

|

|

Box

13:State/Payer’s state no.

|

Text field, maximum 20 characters long. Must be formatted State Abbreviation/State ID such as IL/2851417 .

|

IL/1234-5678

|

|

Box 14:State distribution

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

233.45

|

|

Box

15:Local tax withheld

|

Numeric field (shouldn’t include any non-numeric characters

like a ",").

|

100.2

|

|

Box

16:Name of locality

|

Text field, maximum 12 characters long.

|

CLARKS

|

|

Box

17:Local distribution

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

133.56

|

|

Date of payment

|

Text field, maximum 10 characters long. Must be formatted MM/DD/YYYY

|

08/22/2018

|

|

1st year of desig. Roth

contrib.

|

Date field formatted as follows: MM/DD/YYYY

|

08/14/2009

|

|

Amount allocable to IRR within 5 years

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

1000.18

|

Importing

1099-S Forms

CSV (comma separated value) is the most common format used

in order to transfer data between different types of databases. Most software

and database applications will allow you to export 1099 data into CSV format,

which can then be imported into W2 Mate.

If

your

software

exports

data

to

Microsoft

Excel

format,

you

can

save

the

Excel

file

as

CSV

(Comma

Delimited)

and

then

do

the

import

into

W2

Mate.

IMPORTANT NOTE: A SAMPLE CSV FILE WITH 1099-S DATA CAN BE DOWNLOADED FROM HERE

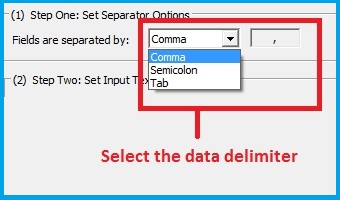

Steps for Importing

1099-S Form Data

- Go to

Import Data >> Other Forms (CSV – Excel) >> 1099-S Forms.

- In

the dialog that comes up:

- Select

the character that is used to separate data categories (columns). The default value should be OK in most cases.

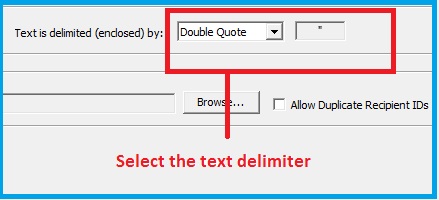

- Select

the character that is used to enclose strings. The default value should be OK in most cases.

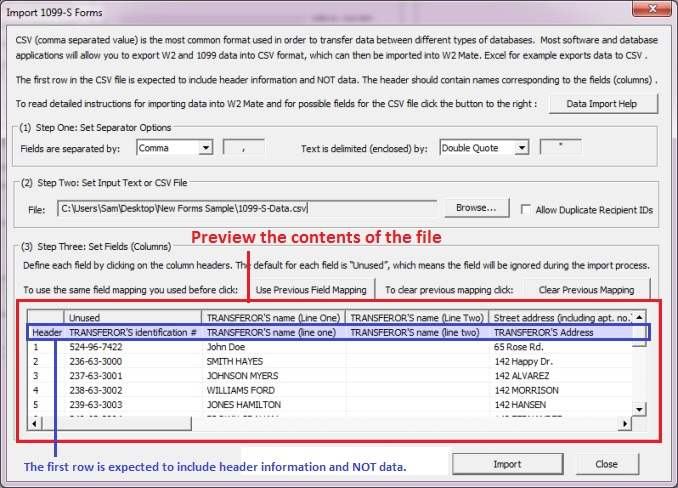

- Select

the input text or CSV file you are trying to import.

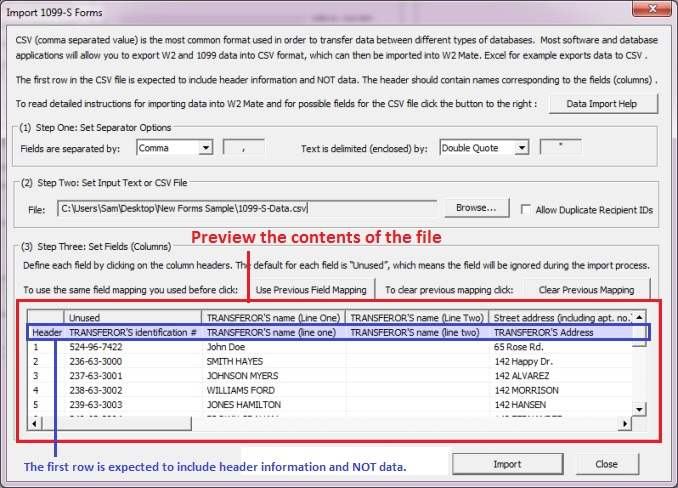

Important

Note: The first row is expected to include header information and NOT data. The

header should contain names corresponding to the fields (columns) in the file

and should contain the same number of fields (columns) as the records in the

rest of the CSV file.

Once you select the input file you

should see a preview for the contents of the file.

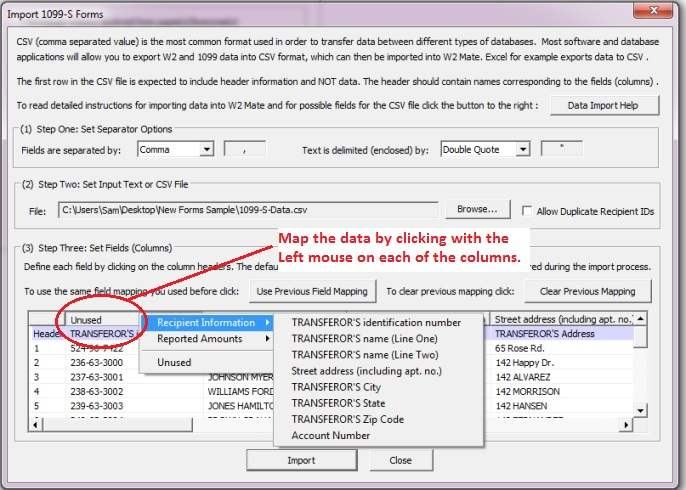

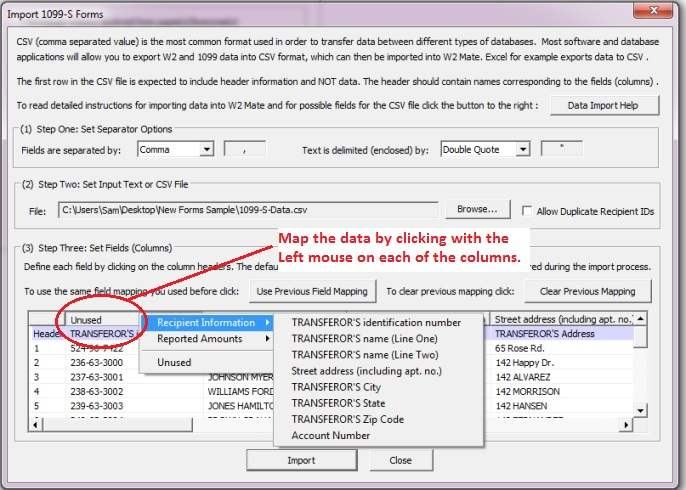

- Map

the data by clicking with the Left

mouse on each of the columns.

- Once

you have defined all the required fields, hit the Import button to import

the new data.

Possible Fields for the

CSV or Text File

|

Field Name

|

Notes

|

Example

|

|

TRANSFEROR'S Tax Identification Number

|

This is a mandatory field.

Text field, maximum 11 characters long.

|

652-45-7888

|

|

TRANSFEROR'S Name (Line One)

|

This is a mandatory field.

Text field, maximum 40 characters long.

|

John Doe

|

|

TRANSFEROR'S Name (Line Two)

|

Text field, maximum 40 characters long.

|

|

|

TRANSFEROR'S Address1

|

Text field, maximum 30 characters long.

|

South Orange Drive

|

|

TRANSFEROR'S City

|

Text field, maximum 20 characters long.

|

Banana

Town

|

|

TRANSFEROR'S State

|

Must be one of the following:

AA, AC, AE,

AK,

AL, AP, AR, AS, AZ, CA,

CO, CT, DC, DE, FL, GA, GU, HI, IA, ID, IL,

IN, KS, KY, LA, MA, MD, ME, MI, MN, MO,

MP, MS, MT, NC, ND, NE, NH, NJ, NM, NV, NY,

OH, OK, OR, PA, PR, RI, SC, SD, TN, TX, UT, VA,

VI, VT, WA, WI, WV, WY

|

IL

|

|

TRANSFEROR'S Zip Code

|

Text field, maximum 11 characters long.

|

25201

|

|

Account Number

|

Text field, maximum 12 characters long.

|

652-999

|

|

Box 1 Date of closing

|

Text field, maximum 15 characters long.

|

11/22/2010

|

|

Box 2 Gross proceeds

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

57500.00

|

|

Box 3 Address or legal description (Line 1)

|

Text field, maximum 26 characters long.

|

104 S. Banana St.

|

|

Box 3 Address or legal description (Line 2)

|

Text field, maximum 26characters long.

|

Hope, IL. 60661

|

|

Box 3 Address or legal description (Line 3)

|

Text field, maximum 26 characters long.

|

|

|

Box 4 Transferor received or will receive property or services

|

This field can either be 1 or 0.

1 means the check box is checked and 0 means it is unchecked.

|

0

|

|

Box 5 Check here if the transferor is a foreign person.

|

This field can either be 1 or 0.

1 means the check box is checked and 0 means it is unchecked.

|

0

|

|

Box 6 Buyer's part of real estate tax

|

Numeric field (shouldn’t include any non-numeric characters like a ",")

|

785.25

|

|

2nd TIN not.

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

0

|

Importing

1098-T Forms

CSV (comma separated value) is the most common format used

in order to transfer data between different types of databases. Most software

and database applications will allow you to export 1099 data into CSV format,

which can then be imported into W2 Mate.

If

your

software

exports

data

to

Microsoft

Excel

format,

you

can

save

the

Excel

file

as

CSV

(Comma

Delimited)

and

then

do

the

import

into

W2

Mate.

IMPORTANT NOTE: A SAMPLE CSV FILE WITH 1098-T DATA CAN BE DOWNLOADED FROM HERE

Steps for Importing

1098-T Form Data

- Go to

Import Data >> Other Forms (CSV – Excel) >> 1098-T Forms.

- In

the dialog that comes up:

- Select

the character that is used to separate data categories (columns). The default value should be OK in most cases.

- Select

the character that is used to enclose strings. The default value should be OK in most cases.

- Select

the input text or CSV file you are trying to import.

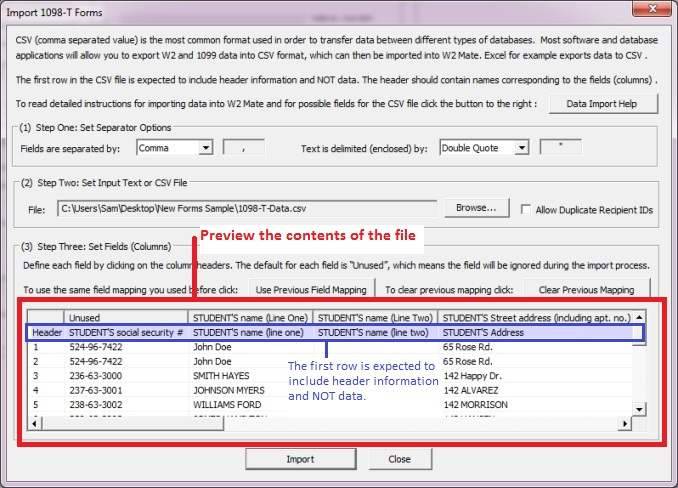

Important

Note: The first row is expected to include header information and NOT data. The

header should contain names corresponding to the fields (columns) in the file

and should contain the same number of fields (columns) as the records in the

rest of the CSV file.

Once you select the input file you

should see a preview for the contents of the file.

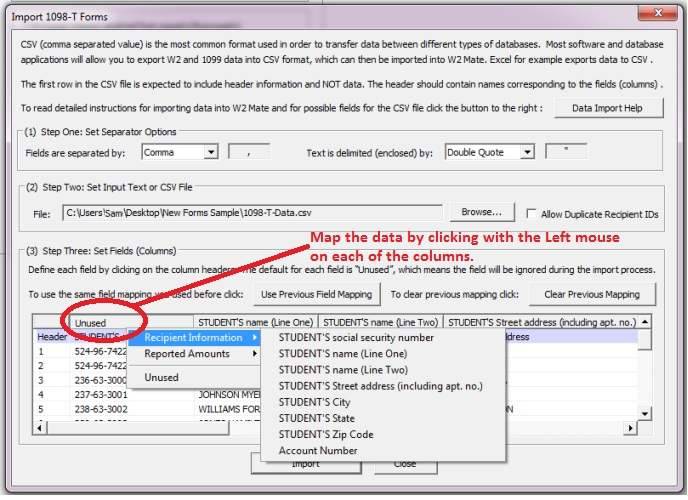

- Map

the data by clicking with the Left

mouse on each of the columns.

- Once

you have defined all the required fields, hit the Import button to import

the new data.

Possible Fields for the

CSV or Text File

|

Field Name

|

Notes

|

Example

|

|

STUDENT'S social security number

|

This is a mandatory field.

Text field, maximum 11 characters long.

|

652-45-7888

|

|

Check Box for STUDENT'S taxpayer ID number Certification

|

This field can either be 1 or 0. 1 means the check box is checked and 0, means it's unchecked.

|

1

|

|

STUDENT'S Name (Line One)

|

This is a mandatory field.

Text field, maximum 40 characters long.

|

John Doe

|

|

STUDENT'S Name (Line Two)

|

Text field, maximum 40 characters long.

|

|

|

STUDENT'S Address1

|

Text field, maximum 30 characters long.

|

South Orange Drive

|

|

STUDENT'S City

|

Text field, maximum 20 characters long.

|

Banana

Town

|

|

STUDENT'S State

|

Must be one of the following:

AA, AC, AE,

AK,

AL, AP, AR, AS, AZ, CA,

CO, CT, DC, DE, FL, GA, GU, HI, IA, ID, IL,

IN, KS, KY, LA, MA, MD, ME, MI, MN, MO,

MP, MS, MT, NC, ND, NE, NH, NJ, NM, NV, NY,

OH, OK, OR, PA, PR, RI, SC, SD, TN, TX, UT, VA,

VI, VT, WA, WI, WV, WY

|

IL

|

|

STUDENT'S Zip Code

|

Text field, maximum 11 characters long.

|

25201

|

|

Account Number

|

Text field, maximum 12 characters long.

|

652-999

|

|

Box 1 Payments received for qualified tuition and related expenses

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

12500.00

|

|

Reserved

|

Reserved

|

|

|

Box 3 Reporting method changed from the previous year

|

This field can either be 1 or 0. 1 means the check box is checked and 0, means it's unchecked.

|

1 |

|

Box 4 Adjustments made for prior year

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

1000.00

|

|

Box 5 Scholarships or grants

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

3200.00

|

|

Box 6 Adjustments to scholarships or grants for a prior year

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

700.00

|

|

Box 7 Academic Period Indicator

|

This field can either be 1 or 0. 1 means the check box is checked and 0, means it's unchecked.

|

0

|

|

Box 8 Half time Student Indicator

|

This field can either be 1 or 0. 1 means the check box is checked and 0, means it's unchecked.

|

1

|

|

Box 9 Graduate Student Indicator

|

This field can either be 1 or 0. 1 means the check box is checked and 0, means it's unchecked.

|

1

|

|

Box 10 Reimbursements or refunds of qualified tuition

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

1000.50

|

|

2nd TIN not.

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

0

|

Importing

1098 Forms

CSV (comma separated value) is the most common format used

in order to transfer data between different types of databases. Most software

and database applications will allow you to export 1099 data into CSV format,

which can then be imported into W2 Mate.

If

your

software

exports

data

to

Microsoft

Excel

format,

you

can

save

the

Excel

file

as

CSV

(Comma

Delimited)

and

then

do

the

import

into

W2

Mate.

IMPORTANT NOTE: A SAMPLE CSV FILE WITH 1098 DATA CAN BE DOWNLOADED FROM HERE

Steps for Importing

1098 Form Data

- Go to

Import Data >> Other Forms (CSV – Excel) >> 1098 Forms.

- In

the dialog that comes up:

- Select

the character that is used to separate data categories (columns). The default value should be OK in most cases.

- Select

the character that is used to enclose strings. The default value should be OK in most cases.

- Select

the input text or CSV file you are trying to import.

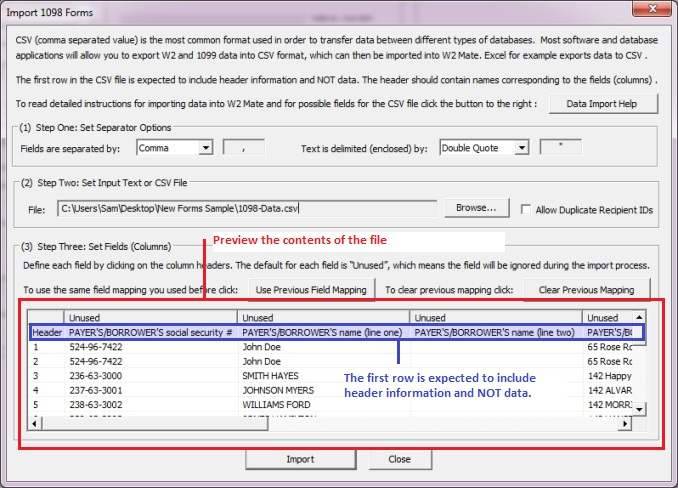

Important

Note: The first row is expected to include header information and NOT data. The

header should contain names corresponding to the fields (columns) in the file

and should contain the same number of fields (columns) as the records in the

rest of the CSV file.

Once you select the input file you

should see a preview for the contents of the file.

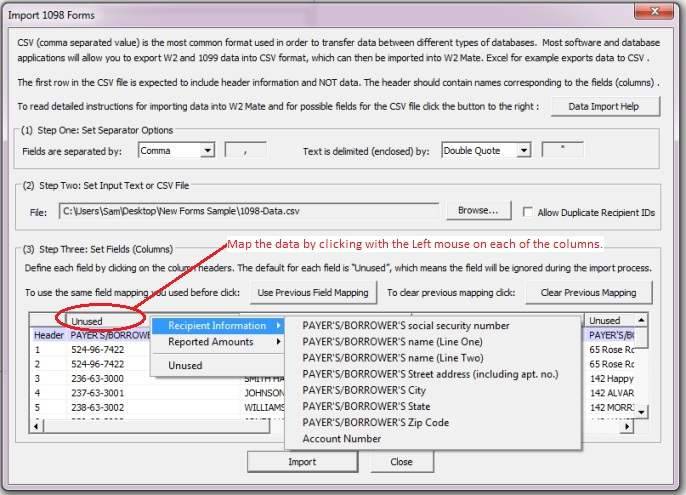

- Map

the data by clicking with the Left

mouse on each of the columns.

- Once

you have defined all the required fields, hit the Import button to import

the new data.

Possible Fields for the

CSV or Text File

|

Field Name

|

Notes

|

Example

|

|

PAYER'S/BORROWER'S taxpayer identification no.

|

This is a mandatory field.

Text field, maximum 11 characters long.

|

652-45-7888

|

|

PAYER'S/BORROWER'S Name (Line One)

|

This is a mandatory field.

Text field, maximum 40 characters long.

|

John Doe

|

|

PAYER'S/BORROWER'S Name (Line Two)

|

Text field, maximum 40 characters long.

|

|

|

PAYER'S/BORROWER'S Address1

|

Text field, maximum 30 characters long.

|

South Orange Drive

|

|

PAYER'S/BORROWER'S City

|

Text field, maximum 20 characters long.

|

Banana

Town

|

|

PAYER'S/BORROWER'S State

|

Must be one of the following:

AA, AC, AE,

AK,

AL, AP, AR, AS, AZ, CA,

CO, CT, DC, DE, FL, GA, GU, HI, IA, ID, IL,

IN, KS, KY, LA, MA, MD, ME, MI, MN, MO,

MP, MS, MT, NC, ND, NE, NH, NJ, NM, NV, NY,

OH, OK, OR, PA, PR, RI, SC, SD, TN, TX, UT, VA,

VI, VT, WA, WI, WV, WY

|

IL

|

|

PAYER'S/BORROWER'S Zip Code

|

Text field, maximum 11 characters long.

|

25201

|

|

Account Number

|

Text field, maximum 12 characters long.

|

652-999

|

|

Box 1 Mortgage interest received from payer(s)/borrower(s)

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

8953.25

|

|

Box 2 Outstanding mortgage principal

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

55698.25

|

|

Box 3 Mortgage origination date

|

Text field, maximum 10 characters long. Must be formatted MM/DD/YYYY

|

02/22/2014

|

|

Box 4 Refund (or credit) of overpaid interest

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

100.00

|

|

Box 5 Mortgage insurance premiums

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

166.31

|

|

Box 6 Points paid on purchase of principal residence

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

500.00

|

|

Box 7 Is address of property securing mortgage same as Borrower's address

|

This field can either be 1 or 0.

1 means the check box is checked and 0, means it is unchecked.

|

0

|

|

Box 8 Address or description of property securing mortgage (Line 1) |

Text field, maximum 38 characters long. |

1678 Happy Ln. Unit 2S |

|

Box 8 Address or description of property securing mortgage (Line 2) |

Text field, maximum 38 characters long. |

Peach Town NC 28209 |

|

Box 9 Number of mortgaged properties |

A number without fractions(an integer) |

2 |

|

Box 10 Other |

Text field, maximum 35 characters long. |

Other notes to borrower |

|

Box 11 Mortgage acquisition date

|

Text field, maximum 10 characters long. Must be formatted MM/DD/YYYY

|

02/22/2014

|

|

2nd TIN not.

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

0

|

Importing

1099-A Forms

CSV (comma separated value) is the most common format used

in order to transfer data between different types of databases. Most software

and database applications will allow you to export 1099 data into CSV format,

which can then be imported into W2 Mate.

If

your

software

exports

data

to

Microsoft

Excel

format,

you

can

save

the

Excel

file

as

CSV

(Comma

Delimited)

and

then

do

the

import

into

W2

Mate.

IMPORTANT NOTE: A SAMPLE CSV FILE WITH 1099-A DATA CAN BE DOWNLOADED FROM HERE

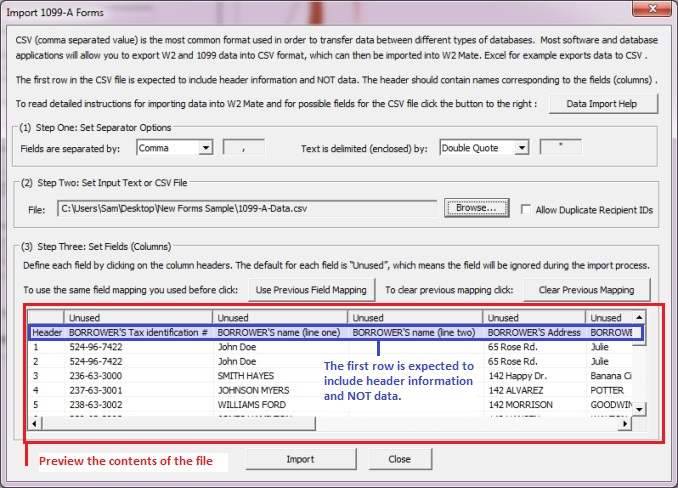

Steps for Importing

1099-A Form Data

- Go to

Import Data >> Other Forms (CSV – Excel) >> 1099-A Forms.

- In

the dialog that comes up:

- Select

the character that is used to separate data categories (columns). The default value should be OK in most cases.

- Select

the character that is used to enclose strings. The default value should be OK in most cases.

- Select

the input text or CSV file you are trying to import.

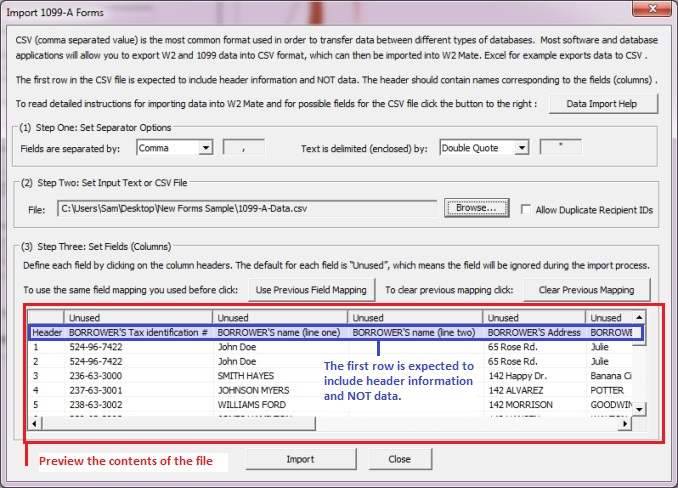

Important

Note: The first row is expected to include header information and NOT data. The

header should contain names corresponding to the fields (columns) in the file

and should contain the same number of fields (columns) as the records in the

rest of the CSV file.

Once you select the input file you

should see a preview for the contents of the file.

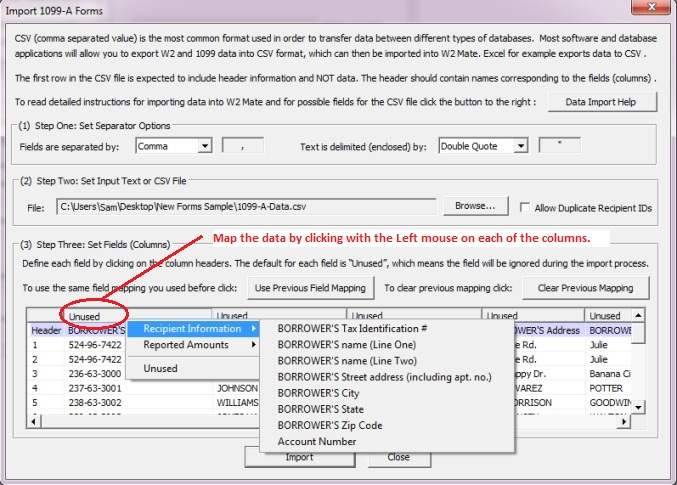

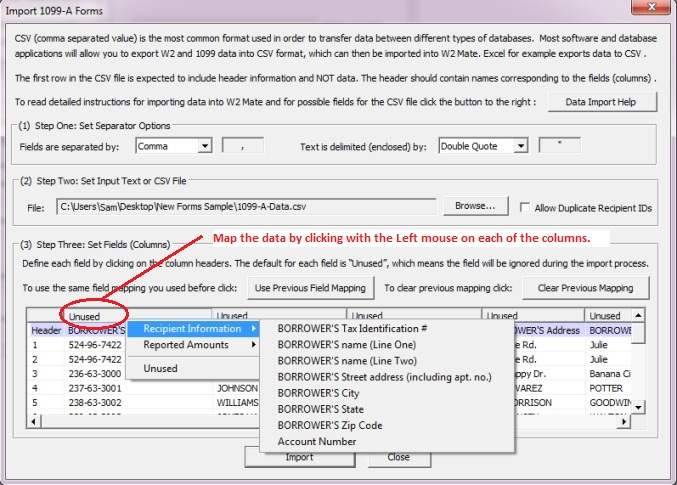

- Map

the data by clicking with the Left

mouse on each of the columns.

- Once

you have defined all the required fields, hit the Import button to import

the new data.

Possible Fields for the

CSV or Text File

|

Field Name

|

Notes

|

Example

|

|

BORROWER'S Tax Identification #

|

This is a mandatory field.

Text field, maximum 11 characters long.

|

652-45-7888

|

|

BORROWER'S Name (Line One)

|

This is a mandatory field.

Text field, maximum 40 characters long.

|

John Doe

|

|

BORROWER'S Name (Line Two)

|

Text field, maximum 40 characters long.

|

|

|

BORROWER'S Address1

|

Text field, maximum 30 characters long.

|

South Orange Drive

|

|

BORROWER'S City

|

Text field, maximum 20 characters long.

|

Banana

Town

|

|

BORROWER'S State

|

Must be one of the following:

AA, AC, AE,

AK,

AL, AP, AR, AS, AZ, CA,

CO, CT, DC, DE, FL, GA, GU, HI, IA, ID, IL,

IN, KS, KY, LA, MA, MD, ME, MI, MN, MO,

MP, MS, MT, NC, ND, NE, NH, NJ, NM, NV, NY,

OH, OK, OR, PA, PR, RI, SC, SD, TN, TX, UT, VA,

VI, VT, WA, WI, WV, WY

|

IL

|

|

BORROWER'S Zip Code

|

Text field, maximum 11 characters long.

|

25201

|

|

Box 1 Date of Lender's Acquisition or Knowledge of Abandonment

|

Text field, maximum 15 characters long.

|

12/22/2010

|

|

Box 2 Balance of principal outstanding

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

135625.14

|

|

Box 4 Fair market value of property

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

140500.00

|

|

Box 5 Borrower was personally liable for repayment of the debt.

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

1

|

|

Box 6 Description of property Line 1

|

Text field, maximum 26 characters long.

|

104 S. Banana St.

|

|

Box 6 Description of property Line 2

|

Text field, maximum 26 characters long.

|

Hope, IL. 60661

|

|

2nd TIN not.

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

0

|

Importing

1099-B Forms

CSV (comma separated value) is the most common format used

in order to transfer data between different types of databases. Most software

and database applications will allow you to export 1099 data into CSV format,

which can then be imported into W2 Mate.

If

your

software

exports

data

to

Microsoft

Excel

format,

you

can

save

the

Excel

file

as

CSV

(Comma

Delimited)

and

then

do

the

import

into

W2

Mate.

IMPORTANT NOTE: A SAMPLE CSV FILE WITH 1099-B DATA CAN BE DOWNLOADED FROM HERE

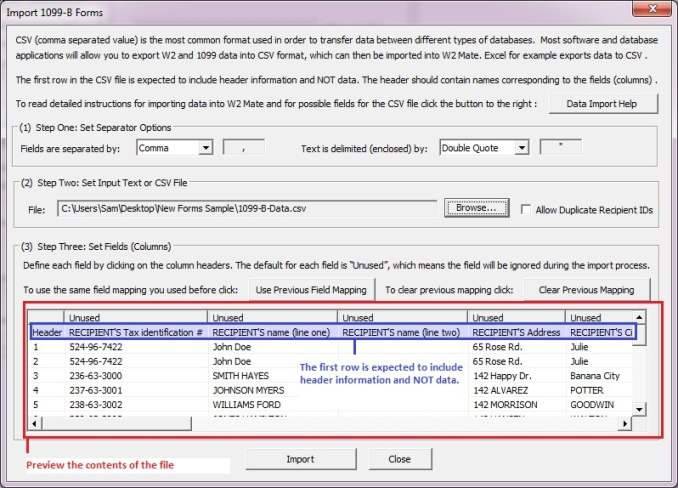

Steps for Importing 1099-B Form Data

- Go to

Import Data >> Other Forms (CSV – Excel) >> 1099-B Forms.

- In

the dialog that comes up:

- Select

the character that is used to separate data categories (columns). The default value should be OK in most cases.

- Select

the character that is used to enclose strings. The default value should be OK in most cases.

- Select

the input text or CSV file you are trying to import.

Important

Note: The first row is expected to include header information and NOT data. The

header should contain names corresponding to the fields (columns) in the file

and should contain the same number of fields (columns) as the records in the

rest of the CSV file.

Once you select the input file you

should see a preview for the contents of the file.

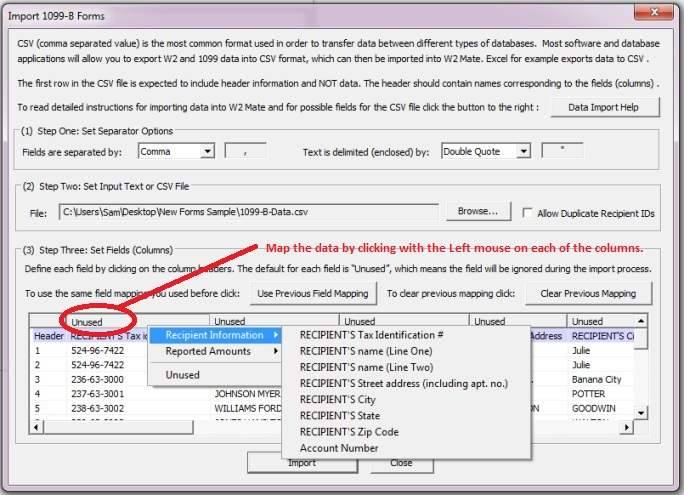

- Map

the data by clicking with the Left

mouse on each of the columns.

- Once

you have defined all the required fields, hit the Import button to import

the new data.

Possible Fields for the

CSV or Text File

|

Field Name

|

Notes

|

Example

|

|

Recipient's Tax Identification number

|

This is a mandatory field.

Text field, maximum 11 characters long.

|

652-45-7888

|

|

Recipient's Name (Line One)

|

This is a mandatory field.

Text field, maximum 40 characters long.

|

John Doe

|

|

Recipient's Name (Line Two)

|

Text field, maximum 40 characters long.

|

|

|

Recipient's Address1

|

Text field, maximum 30 characters long.

|

South Orange Drive

|

|

Recipient's City

|

Text field, maximum 20 characters long.

|

Banana

Town

|

|

Recipient's State

|

Must be one of the following:

AA, AC, AE,

AK,

AL, AP, AR, AS, AZ, CA,

CO, CT, DC, DE, FL, GA, GU, HI, IA, ID, IL,

IN, KS, KY, LA, MA, MD, ME, MI, MN, MO,

MP, MS, MT, NC, ND, NE, NH, NJ, NM, NV, NY,

OH, OK, OR, PA, PR, RI, SC, SD, TN, TX, UT, VA,

VI, VT, WA, WI, WV, WY

|

IL

|

|

Recipient's Zip Code

|

Text field, maximum 11 characters long.

|

25201

|

|

Account Number

|

Text field, maximum 12 characters long.

|

652-999

|

|

Applicable check box on Form 8949

|

Text field, maximum 25 characters long.

|

(A)

|

|

Box 1a Description of property

|

Text field, maximum 26 characters long

|

Sample description text

|

|

Box 1b Date acquired

|

Text field, maximum 15 characters long.

|

10/22/2011

|

|

Box 1c Date sold or disposed

|

Text field, maximum 15 characters long.

|

10/15/2010

|

|

Box 1d Proceeds

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5800.14

|

|

Box 1e Cost or other basis

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5800.14

|

|

Box 1f Accrued market discount

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

150.00

|

|

Box 1g Wash sale loss disallowed

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

700.14

|

|

Box 2 Type of gain or loss Short-term

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

1

|

|

Box 2 Type of gain or loss Long-term

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

1

|

|

Box 2 Ordinary

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

1

|

|

Box 3 Check if proceeds from collectibles

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

1

|

|

Box 3 Check if proceeds from QOF

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

1

|

|

Box 4 Federal income tax withheld

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

700.14

|

|

Box 5 Non-covered security

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

1

|

|

Box 6 Reported to IRS as Gross proceeds

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

1

|

|

Box 6 to Reported IRS as Net proceeds

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

1

|

|

Box 7 Check if loss not allowed based on amount in box 1d

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

1

|

|

Box 8 Profit or (loss) realized (this year) on closed contracts

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5800.14

|

|

Box 9 Unrealized profit or (loss) on open contracts - 12/31 Last Year

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5800.14

|

|

Box 10 Unrealized profit or (loss) on open contracts - 12/31 This year

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5800.14

|

|

Box 11 Aggregate profit or (loss) on contracts

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5800.14

|

|

Box 12 Basis reported to IRS

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

1

|

|

Box 12 Check if proceeds from collectibles

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

1

|

|

Box 13 Bartering

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

5800.14

|

|

Box 14 State Name

|

Must be one of the following:

AA, AC, AE,

AK,

AL, AP, AR, AS, AZ, CA,

CO, CT, DC, DE, FL, GA, GU, HI, IA, ID, IL,

IN, KS, KY, LA, MA, MD, ME, MI, MN, MO,

MP, MS, MT, NC, ND, NE, NH, NJ, NM, NV, NY,

OH, OK, OR, PA, PR, RI, SC, SD, TN, TX, UT, VA,

VI, VT, WA, WI, WV, WY

|

NC

|

|

Box 15 State identification no

|

Text field, maximum 20 characters long.

|

8554-555-1

|

|

Box 16 State tax withheld

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

205.6

|

|

CUSIP number

|

Text field, maximum 15 characters long

|

|

|

2nd TIN not.

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

0

|

Importing 1099-C Forms

CSV (comma separated value) is the most common format used

in order to transfer data between different types of databases. Most software

and database applications will allow you to export 1099 data into CSV format,

which can then be imported into W2 Mate.

If

your

software

exports

data

to

Microsoft

Excel

format,

you

can

save

the

Excel

file

as

CSV

(Comma

Delimited)

and

then

do

the

import

into

W2

Mate.

IMPORTANT NOTE: A SAMPLE CSV FILE WITH 1099-C DATA CAN BE DOWNLOADED FROM HERE

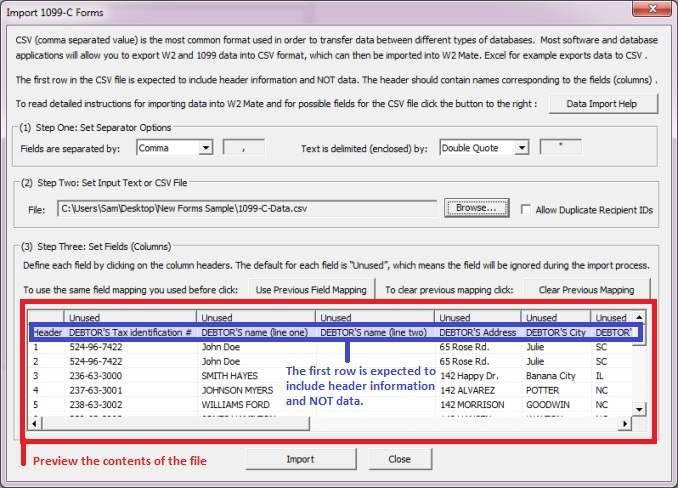

Steps for Importing

1099-C Form Data

- Go to

Import Data >> Other Forms (CSV – Excel) >> 1099-C Forms.

- In

the dialog that comes up:

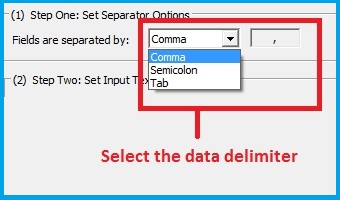

- Select

the character that is used to separate data categories (columns). The default value should be OK in most cases.

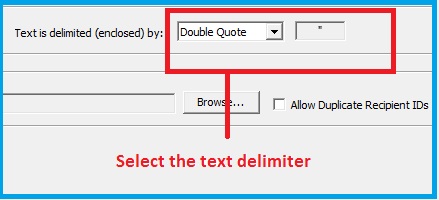

- Select

the character that is used to enclose strings. The default value should be OK in most cases.

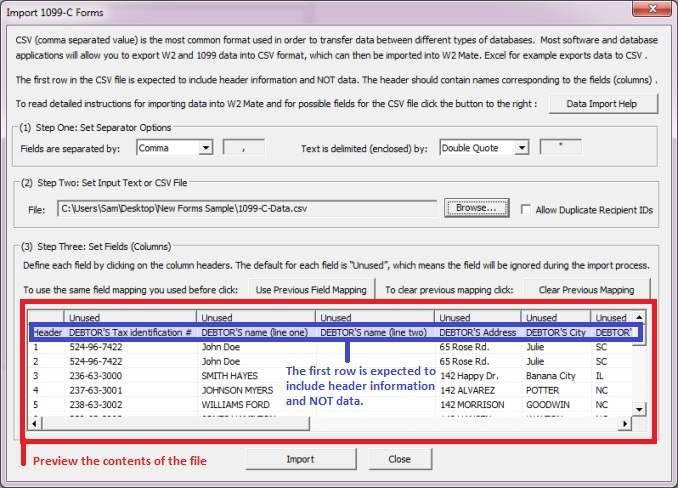

- Select

the input text or CSV file you are trying to import.

Important

Note: The first row is expected to include header information and NOT data. The

header should contain names corresponding to the fields (columns) in the file

and should contain the same number of fields (columns) as the records in the

rest of the CSV file.

Once you select the input file you

should see a preview for the contents of the file.

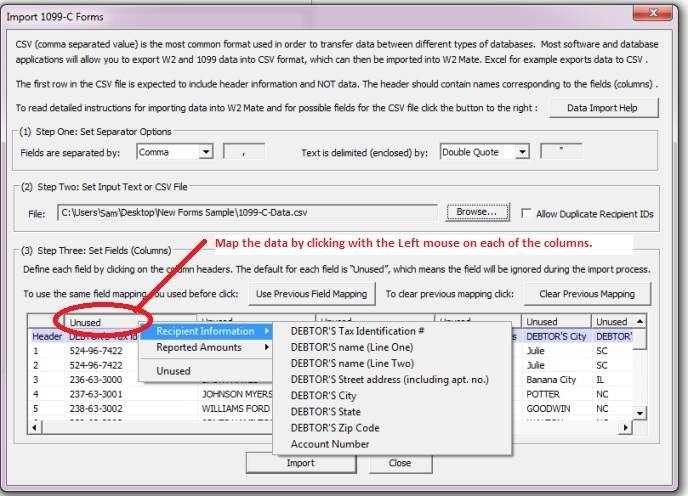

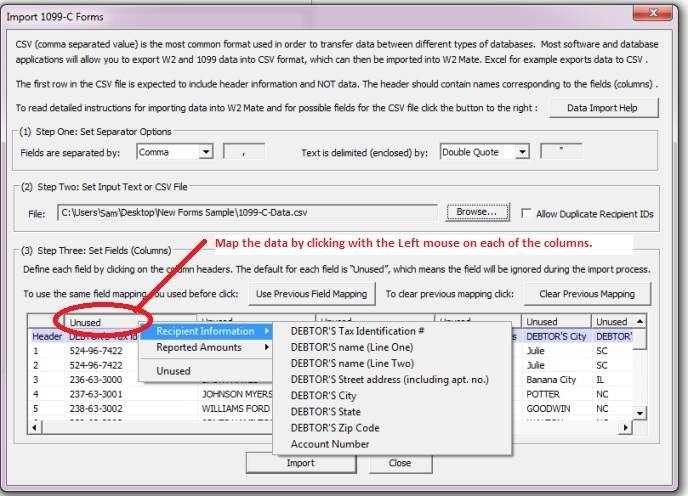

- Map

the data by clicking with the Left

mouse on each of the columns.

- Once

you have defined all the required fields, hit the Import button to import

the new data.

Possible Fields for the

CSV or Text File

|

Field Name

|

Notes

|

Example

|

|

DEBTOR'S Tax Identification #

|

This is a mandatory field.

Text field, maximum 11 characters long.

|

652-45-7888

|

|

DEBTOR'S Name (Line One)

|

This is a mandatory field.

Text field, maximum 40 characters long.

|

John Doe

|

|

DEBTOR'S Name (Line Two)

|

Text field, maximum 40 characters long.

|

|

|

DEBTOR'S Address1

|

Text field, maximum 30 characters long.

|

South Orange Drive

|

|

DEBTOR'S City

|

Text field, maximum 20 characters long.

|

Banana

Town

|

|

DEBTOR'S State

|

Must be one of the following:

AA, AC, AE,

AK,

AL, AP, AR, AS, AZ, CA,

CO, CT, DC, DE, FL, GA, GU, HI, IA, ID, IL,

IN, KS, KY, LA, MA, MD, ME, MI, MN, MO,

MP, MS, MT, NC, ND, NE, NH, NJ, NM, NV, NY,

OH, OK, OR, PA, PR, RI, SC, SD, TN, TX, UT, VA,

VI, VT, WA, WI, WV, WY

|

IL

|

|

DEBTOR'S Zip Code

|

Text field, maximum 11 characters long.

|

25201

|

|

Account Number

|

Text field, maximum 12 characters long.

|

652-999

|

|

Box 1 Date of identifiable event

|

Text field, maximum 15 characters long.

|

11/28/2010

|

|

Box 2 Amount of debt discharged

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

155865.25

|

|

Box 3 Interest if included in box 2

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

98632.47

|

|

Box 4 Debt description Line 1

|

Text field, maximum 26 characters long.

|

Sample description text

|

|

Box 4 Debt description Line 2

|

Text field, maximum 26 characters long.

|

|

|

Box 4 Debt description Line 3

|

Text field, maximum 26 characters long.

|

|

|

Box 5 Debtor was personally liable for repayment of the debt

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

1

|

|

Box 6 Identifiable event code

|

Text field, maximum 2 characters long.

|

A

|

|

Box 7 Fair market value of property

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

176500.00

|

|

2nd TIN not.

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

0

|

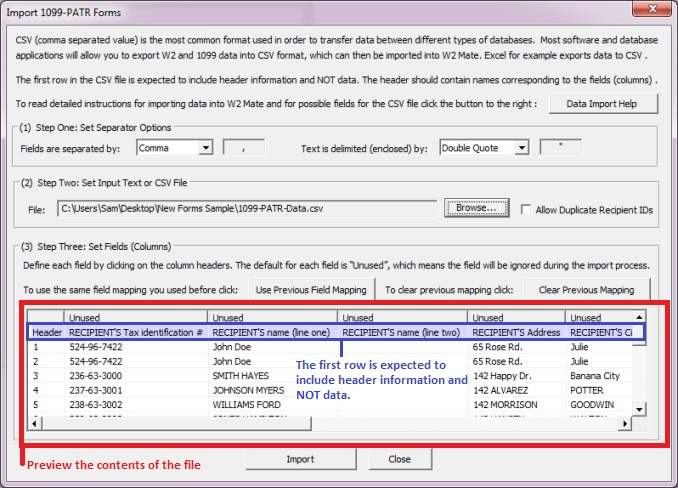

Importing

1099-PATR Forms

CSV (comma separated value) is the most common format used

in order to transfer data between different types of databases. Most software

and database applications will allow you to export 1099 data into CSV format,

which can then be imported into W2 Mate.

If

your

software

exports

data

to

Microsoft

Excel

format,

you

can

save

the

Excel

file

as

CSV

(Comma

Delimited)

and

then

do

the

import

into

W2

Mate.

IMPORTANT NOTE: A SAMPLE CSV FILE WITH 1099-PATR DATA CAN BE DOWNLOADED FROM HERE

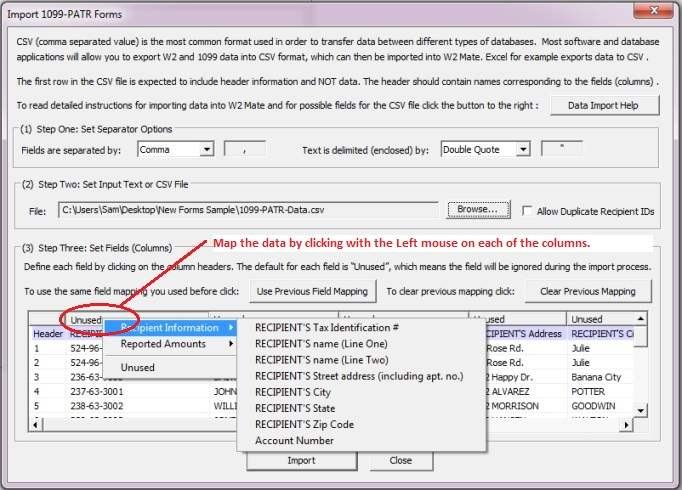

Steps for Importing 1099-PATR Form Data

- Go to

Import Data >> Other Forms (CSV – Excel) >> 1099-PATR Forms.

- In

the dialog that comes up:

- Select

the character that is used to separate data categories (columns). The default value should be OK in most cases.

- Select

the character that is used to enclose strings. The default value should be OK in most cases.

- Select

the input text or CSV file you are trying to import.

Important

Note: The first row is expected to include header information and NOT data. The

header should contain names corresponding to the fields (columns) in the file

and should contain the same number of fields (columns) as the records in the

rest of the CSV file.

Once you select the input file you

should see a preview for the contents of the file.

- Map

the data by clicking with the Left

mouse on each of the columns.

- Once

you have defined all the required fields, hit the Import button to import

the new data.

Possible Fields for the

CSV or Text File

|

Field Name

|

Notes

|

Example

|

|

Recipient's Tax Identification number

|

This is a mandatory field.

Text field, maximum 11 characters long.

|

652-45-7888

|

|

Recipient's Name (Line One)

|

This is a mandatory field.

Text field, maximum 40 characters long.

|

John Doe

|

|

Recipient's Name (Line Two)

|

Text field, maximum 40 characters long.

|

|

|

Recipient's Address1

|

Text field, maximum 30 characters long.

|

South Orange Drive

|

|

Recipient's City

|

Text field, maximum 20 characters long.

|

Banana

Town

|

|

Recipient's State

|

Must be one of the following:

AA, AC, AE,

AK,

AL, AP, AR, AS, AZ, CA,

CO, CT, DC, DE, FL, GA, GU, HI, IA, ID, IL,

IN, KS, KY, LA, MA, MD, ME, MI, MN, MO,

MP, MS, MT, NC, ND, NE, NH, NJ, NM, NV, NY,

OH, OK, OR, PA, PR, RI, SC, SD, TN, TX, UT, VA,

VI, VT, WA, WI, WV, WY

|

IL

|

|

Recipient's Zip Code

|

Text field, maximum 11 characters long.

|

25201

|

|

Account Number

|

Text field, maximum 12 characters long.

|

652-999

|

|

Box 1 Patronage dividends

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

1000.00

|

|

Box 2 Nonpatronage distributions

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

500.00

|

|

Box 3 Perunit retain allocations

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

200.00

|

|

Box 4 Federal income tax withheld

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

400.00

|

|

Box 5 Redemption of nonqualified notices and retain allocations

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

1000.00

|

|

Box 6 Domestic production activities deduction

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

|

|

Box 7 Qualified payments

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

|

|

Box 8 Investment credit

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

|

|

Box 9 Work opportunity credit

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

|

|

Box 10 Patrons AMT adjustment

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

|

|

Box 11 Other credits and deductions

|

Numeric field (shouldn’t include any non-numeric

characters like a ",").

|

|

|

2nd TIN not.

|

This field can either be 1 or 0.

1 means the check box is checked and 0,

means it’s unchecked.

|

1

|

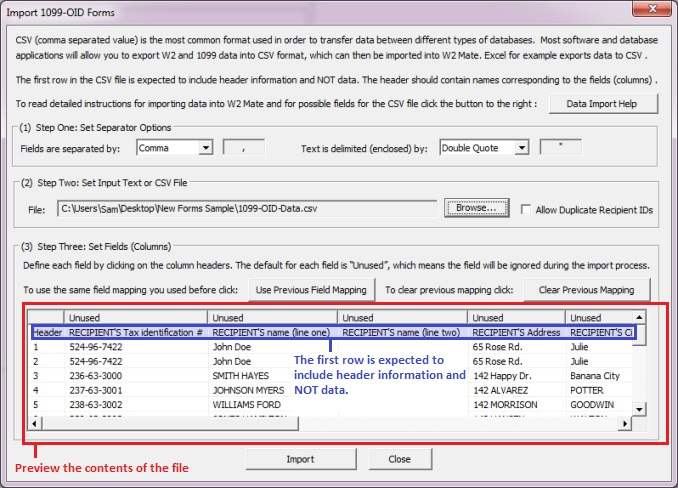

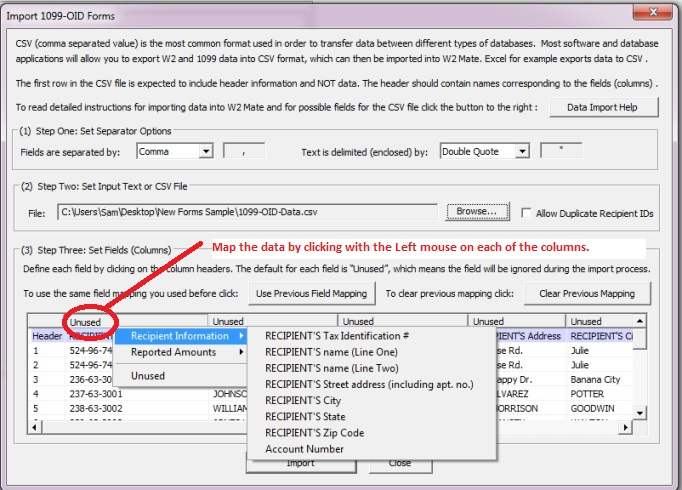

Importing

1099-OID Forms

CSV (comma separated value) is the most common format used